TILA-RESPA Kills Flagler Year End Home Sales Stats

If reported Flagler home closings for Nov. and Dec. had followed the track set by the first ten months, an additional 111 homes would have closed in 2015, representing a 4.6% gap for the year.

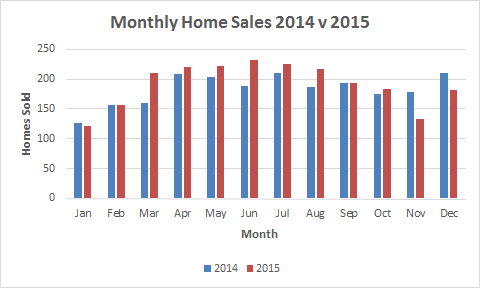

PALM COAST, FL – January 10, 2016 – The net effect of the TILA-RESPA Integrated Disclosure (TRID) rules on real estate closings in Palm Coast and Flagler County was significant. Through October 2015, reported monthly MLS closings of Flagler County single-family residential (SFR) homes showed year over year increases in every month but January. Through October, cumulative home sales were up 9.9% greater than in the same period the previous year.

If November and December had followed the track set by previous months, sales for the year would have been an estimated 2,415 homes. But that’s not what happened. The Consumer Financial Protection Bureau’s new “Know Before You Owe” TILA-RESPA Integrated Disclosures Rule (TRID), mandated by the Dodd-Frank Bill, kicked in October 3rd. It increased the time required to initiate and close home purchase loans initiated after the effective date by an estimated 15 days.

Consequently, sales for November and December were lower year over year by 24.7% and 13.7% respectively. 2015 sales came in at 2,304; 111 fewer than projected. Without the TILA-REAPA delays, the added sales closings would have aggregated more than $20M. Real estate commissions are individually negotiated. Having said that, at the most common level of 6%, the additional sales would have yielded more than $1M in added commission revenue for local real estate practitioners.

Buyers who had their closings pushed into 2016 will delay the effective date of their homestead exemptions by a full year. For Palm Coast residents, that’s an expected tax hit of nearly $850 in 2016. It’s also likely that rising home prices will cause their “Save Our Homes” baseline to be higher, raising property taxes each year thereafter.

Real estate transactions have other tax consequences as well. Apparently, some more affluent buyers opted to close with cash in 2015 rather than delay closing a loan transaction into the new tax year. Cash sales, as a percentage of all sales, were up slightly in December. Uncharacteristically, the median selling price for cash sales ($195,000) was above the overall median price ($184,176) and also above the median selling price of non-distressed properties ($188,000).

Remember. The regulation did not kill sales activity, which is still healthy. It only postponed sales that previously would have closed at the end of 2015 into 2016’s business.

The Federal Government needs to stay out of bankin

It appears from the article that the federal government has “done it again quote. They have managed to destroy with the stroke of the pen an otherwise healthy and growing economy.

They did the same thing when they opened the doors to allow banking, stocks and even insurance to be intermingled. As you know there have been many other federal laws that have caused and even crushed our economy.

When are they going to learn that the economics of supply and demand are the best ones?

Delayed Closings

Please for the sake of clarity, explain how the new requirements add 15 (3 work weeks) to the escrow/closing cycle. With the use of computers and other advances in technology it does not make sense that anything should impact the closing cycle if banks, Realtors and Title Companies are doing their jobs. How many forms are required, how many signatures are required> To simply state the impacts in terms of dollars without explaining the cause of the delays is disingenuous or falsely misleading.

Reply to John Boy

Well hello again John Boy. I haven’t heard from you in a while.

Much has been written about TILLA-RESPA throughout the industry. It has been a generally concluded that the new regulations would extend the typical closing cycle for loans involving mortgages from the traditional 30 days to 45 days. That’s a 15 day increase.

If you would like to read more about the details of the new regulations, read my article of September 28, 2015 titled ‘Real Estate Contracts Change Today, Truth-in-Lending Disclosure Rules Change Saturday.’ Under the GoToby.com NEWS tab, click on All News to find old articles. Also try using the SITE SEARCH feature at the top right of any page of GoToby.com.