Palm Coast, Flagler Co. 2016 Real Estate Year in Review

2016 was the year the Flagler County/Palm Coast housing market emerged from the residual doldrums of the Great Recession. Our first end-to-end look at the cycle; bubble, crash, recovery.

PALM COAST, FL – January 16, 2017 – Flagler County (including Palm Coast) has been called the poster child of the Great Recession. Its housing market suffered for more than ten years. Properties dropped nearly 60% in value. For three years, 2009, 2010 and 2011, more than half of homes sold were either short sales or foreclosures. Palm Coast was featured in a front-page story in the Sunday edition of the Washington Post in June, 2011. That chapter is now over. 2016 marks the year in which the Flagler County housing market emerged from the cycle’s doldrums to regain a sense of normalcy. Now, the first end-to-end look at the cycle that lasted more than a decade; the Bubble, the Crash and the Recovery.

.png)

Flagler's Housing Bubble

The first half of the 2000s was heady times for Flagler County. The frenetic pace of new residential construction was fueled by a fast-growing population and rampant speculation. It was the wild west. It was the real estate equivalent of a Viagra party.

In the two years from July 1, 2003 to July 1, 2005, Flagler County was the fastest growing county (by percent) in the country. Flagler also led in the period from the official April 1, 2000 census to July 1, 2006 with its population increasing from 49,835 to 83,084, a 66.7% increase. (Source: U.S. Census Bureau)

Palm Coast ranked number one in percentage population growth for the period July 1, 2006 to July 1, 2007 (7.2%). More impressively, it also ranked number one for the 2000 – 2007 period with a growth rate of 77.4%. (Source: U.S. Census Bureau)

So many homes were being built that, at times, in fast-growing Grand Haven, you could not drive down some streets for the congestion of construction vehicles. The build time for homes often stretched to two years. In 2005, The Ginn Company sold 340 single-family building lots in The Conservatory over a single weekend for prices ranging from $329,900 to $529,900 with a final tally of $142,000,000.

Flagler's Housing Crash

The first hint that something was amiss was during the second half of 2005. The number of Flagler County single-family homes sold through MLS peaked at 338 in June and started to fall off. By December, the number of home sales had fallen to 174 and was in a freefall. November 2006 registered only 89 sales. January 2008 marked the bottom of the market with only 51 homes sold.

Interestingly, median selling prices continued to rise during the last half of 2005; in the face of declining sales, probably because the declining sales went unnoticed because the sales levels continued to be above comparable months one year earlier. Year-over-year, things still looked rosy. Median prices peaked at $259,950 in December 2005.

The music had stopped and all the chairs were gone. The carnage had just begun. Easy credit led both qualified and unqualified buyers to use 100% financing, fully believing that prices would continue to rise. Once prices began to fall, these borrowers were immediately underwater, unable to sell unless they could bring enough cash to the closing table to cover the difference between the net sale proceeds and the loan balance. Most potential sellers were simply frozen out of the market as it continued its downward spiral. Conservatory lots sold at Tax Deed Sales for less than $20,000.

In past housing market cycles, prices typically dropped about 10%. During the Great Recession, Flagler medium home prices dropped an incredible 59%. Rather than a typical 18-month housing cycle duration, the Great Recession lasted over a decade. There are many reasons.

Traditional mortgage loans required 20% down payment. With a 10% decline in value, owners still had equity. They could still sell. A market remained. With 100% financing, any decline in value put the homeowner underwater. The underwater owner is out of the market, unable to sell, therefor unable to buy another home. Upsizing, downsizing, job relocations and retirement plans were put on hold, exacerbating the decline in the larger economy. Prices continued to decline, adding more homeowners to the “underwater” class at each lower price level.

Although home sales began to recover gradually after January 2008, prices continued to slide. The median selling price finally hit bottom at $106,000 in January 2012.

Home building activity took a more dramatic dive. There were more single-family residential building permits issued in Flagler County in 2005 than in the next eight years combined. February 2005 saw over 400 single-family permits issued. For eight of the months between 2008 and 2011, the permit count was measured in single digits. April 2011 saw only three permits issued.

Flagler's Housing Recovery

To return to a “normal” market, it would be necessary to work through the huge inventory of distressed properties. For underwater property owners who could not “ride it out,” there were several ways to deal with being underwater; none of them pleasant.

- Deed in lieu – Surrender title to the lender “in lieu” of a foreclosure.

- Refinance – Make alternate loan arrangements that are more palatable; different term and/or lower interest rate.

- Short sale – Sell the property at a price less than the outstanding loan balance. This option required the lenders permission. In some cases, the remaining loan balance was forgiven. In other cases, banks settled for an amount from the seller less than the remaining loan balance.

- Foreclosure – Lenders can file for foreclosure once a loan becomes delinquent. Florida is a judicial foreclosure state, meaning that the foreclosure process works its way through the courts. This is typically a long process. Some Florida foreclosures took up to 5 years to complete. The final step in a foreclosure is a public auction where the lender or a third-party bidder takes title. Many homes were sold through short sales after the foreclosure process has begun, thus terminating the foreclosure before an auction.

During 2005, monthly new foreclosure filings averaged 26. In 2006, the average number of new filings rose to 47 per month. New filings peaked at 227 monthly during 2008-2009.

The flood of foreclosures overwhelmed available resources; lawyers, courts, lenders, real estate practitioners, and code enforcement. During the early days of the recovery, short sales dominated. They were messy and took a long time, but they were still better than waiting for the foreclosure process to run its course.

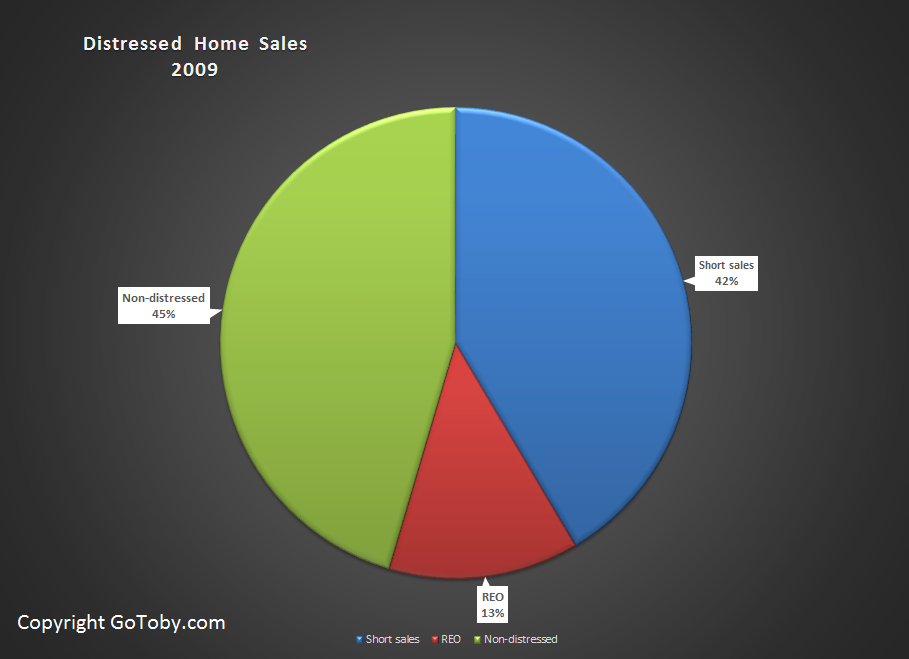

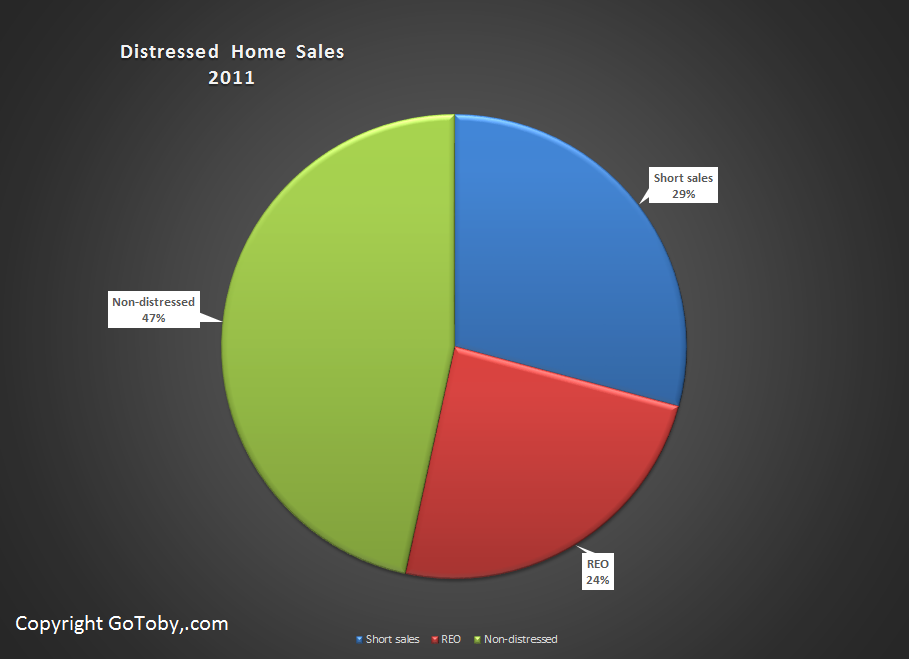

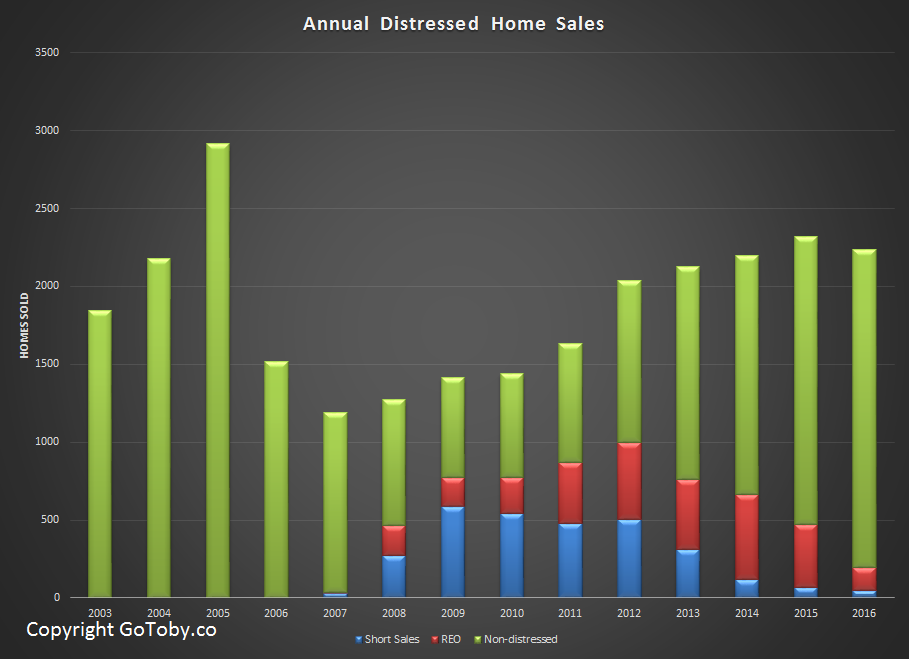

Gradually, lenders and the judicial system became more efficient. More foreclosures were being completed, adding more foreclosed homes to the “for sale” inventory. Before 2007, distressed properties (foreclosed homes and short sales) were a non-factor. By 2008, distressed home sales comprised 36.76% of all home sales. In 2009, 2010 and 2011, the percentage had risen to over 50%.

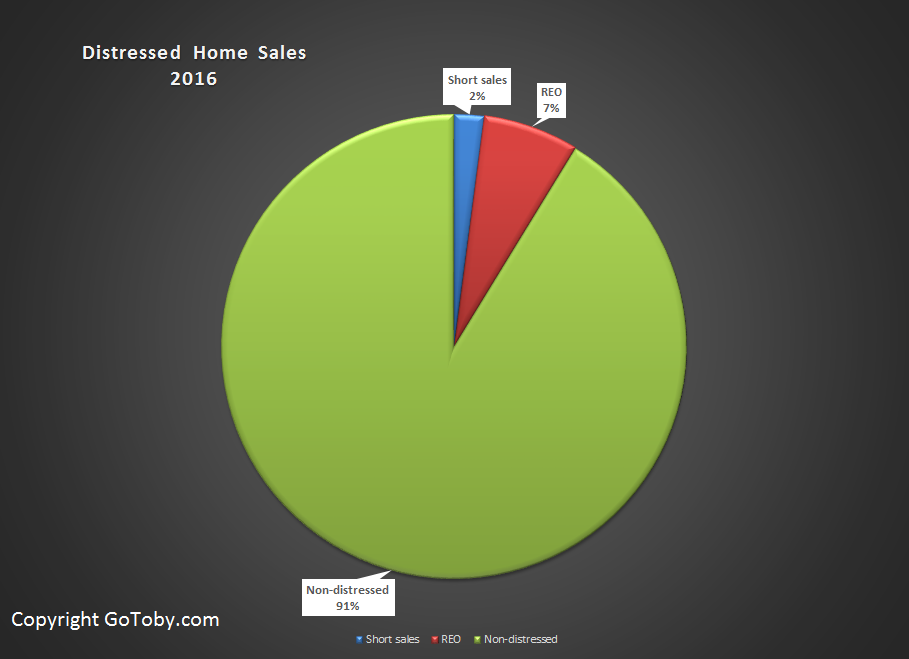

Early on, short sales had dominated the distressed category, but foreclosed sales eventually became the dominant category. Note the changes from 2009 to 2011 and to 2016 in the following pie charts. In 2016, distressed sales fell below 10%. By December, 2016, distressed sales had fallen to only 3.7% of all sales.

Here's another view, showing the rise and decline of distressed home sales during the Great Recession.

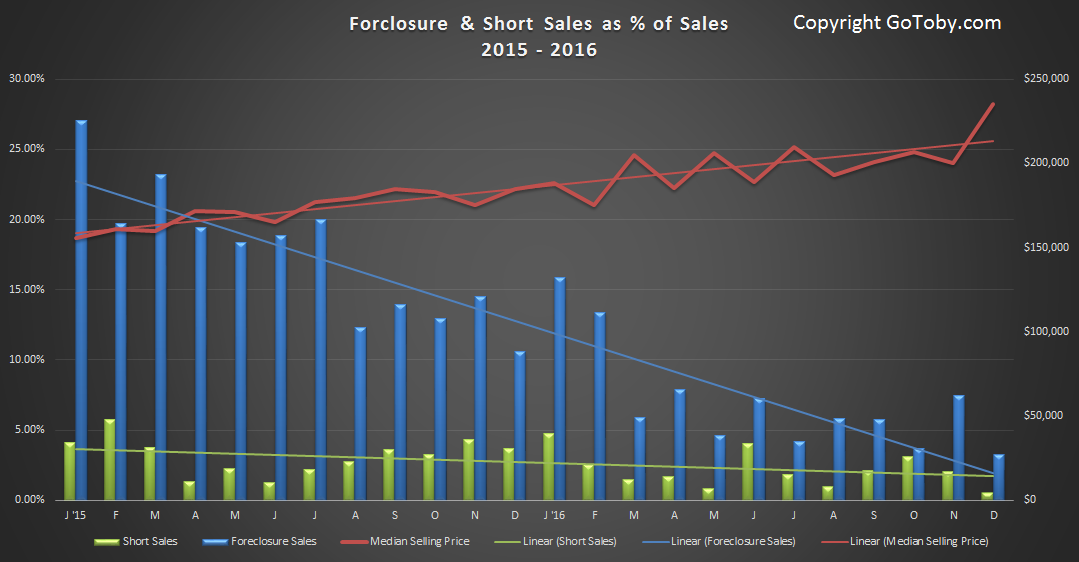

As home prices began to rise in 2012, distressed sales began to decline as a percentage of sales, falling to 20.46% in 2015 and to 8.73% in 2016. By year’s end, distressed sales had become an insignificant segment of the market. We are now in a NORMAL market in that it is no longer unduely influenced by distressed property sales.

The decline in distressed sales during 2015 and 2016 is illustrated below.

This is Important Because….

While Flagler County population growth slowed when the bubble burst, it did not stop. The most recent U.S. Census Bureau’s latest population estimate (for the period of July1, 2014 to July 1, 2015) ranks Flagler County 64th in population growth among all U.S. counties, adding 2,831 new residents. Florida’s Bureau of Economics and Business Research has projected Flagler’s population growth, assuming low growth, medium growth and high growth assumptions. At the Bureau’s low growth assumptions, Flagler’s population will grow to 109,400 by 2020. The medium range population projection is 120,100. The high-end projection is 127,700. At the medium level, population growth will create a need for over 1,300 new residential units per year. At the high end, approximately 2,000 units will be required.

Builders created fewer than 800 new residential units during 2016 and fewer than 600 in the previous two years. So, where have all the recent arrivals settled? Flagler had a healthy inventory of vacant short sale and foreclosed homes; until now. That inventory has evaporated.

Going forward, the pressure to accommodate population growth will fall entirely on new residential construction; homes, condominiums and apartments. To the extent that new construction falls behind demand, prices will rise for both buyers and renters.

During the recovery phase, several local individuals and groups actively purchased distressed properties, brought them back to marketable condition (also with cash) before flipping them. Bubble phase flippers typically used 100% financing. Their exit strategy was to turn around and flip the property at a profit to the speculator in line behind them. They had no concept of the intrinsic value of the home to a real end user. They were pure speculators that fed the frenzy. Eventually, there was nobody in line behind them. The music had stopped and all the chairs were gone.

The recovery flippers’ strategy was well conceived. They raised the value of the distressed homes they flipped. In doing so, they raised the value of the surrounding neighborhood. They deserve credit for the role they played in the recovery.

Flagler Housing Forecast for 2017

GoToby.com expects the number of existing-home sales to remain relatively stable, with no significant increase. Flipping activity during the recovery artificially inflated the number of home sales. Many distressed purchases generated a flip sale within 12 months, creating two transactions. Going forward, we will see few of these double-counted transactions.

Expect a return of the multi-family market; both condominiums and apartments. Atlanta-based Jacoby Group has already closed on property at Marineland previously owned by Centex. Development of that property will likely include condominiums. Jacoby also has the Palm Coast Resort and Marina under contract. Expect news soon about plans to develop that property. The developer rights at Tidelands were recently purchased, including entitlements to develop 134 additional condominiums.

The success of Sunset Inlet, Eagle Lake, Hidden Lakes, Beach Haven, Seagate’s Park Place and DR Horton’s Country Club Harbor will drive more master-planned communities. Jim Cullis is planning a new community in the “L” Section. Grand Reserve in Bunnell is under contract. I expect new single-family residential construction activity there before year’s end. Several homes have been built in The Conservatory. More are under construction.

Progress continues at two neighboring marina projects on Colbert Lane at the old Lehigh Cement factory site. Both plans include condominiums. ICI Homes has purchased Town Center parcels designated for residential development. GoToby.com expects ground to be broken there in 2017. Meanwhile, ICI continues to develop Flagler County lots in Plantation Bay.

One Assisted Living Facility (ALF) is under construction on Palm Harbor Pkwy. Expect three more to begin during the upcoming year. Tractor Supply Co. is scheduled to open later this month. A building permit for an Aldi grocery store has been issued on a parcel adjacent to TSC. There is a Wawa on the horizon. And another Starbucks.

The median of Flagler County single-family non-distressed homes sold through MLS during 2016 was $205,000. GoToby.com expects the median price for those sold in 2017 will be at least 8-10% higher.

Housing 2016 Article

Great article, Toby. So informative! Thank you!

Interest rates

Great article—-adds great perspective on Flagler for anyone living here or planning to.

No mention, however, on what impact different interest rate scenarios would have on home sales. Also, very importantly, projections on where future residents would come from.

Looking forward to your response.

Excellent article

Very good overview

Great Informtion

I have followed your comments and eye to the market for years now. You are right on. Very good job. I appreciate all you postings.