November Flagler Home Sales Down 27 Percent Year-Over-Year

Drop attributed to Dodd-Frank mandates. CFPB’s new “Know Before You Owe” TILA-RESPA Integrated Disclosures Rule (TRID) increases the time for loan initiation and closing by an estimated 15 days.

PALM COAST, FL – December 14, 2015 – Year end housing market statistics will be warped this year. The Consumer Financial Protection Bureau’s new “Know Before You Owe” TILA-RESPA Integrated Disclosures Rule (TRID), mandated by the Dodd-Frank Bill, has increased the time for loan initiations and closings by an estimated 15 days. The regulations effect mortgages applications effective October 3, 2015. Delayed closings involving mortgages during the final months of the year will artificially lower reported housing sales.

The last time November home sales were this low was in 2011 when the median selling price was only $113,000. But aside from the TILA-RESPA induced slowdown in closings, the Palm Coast and Flagler County real estate market is in good health and growing at a steady but rational pace.

Single-family residential homes

The median selling price for MLS-reported home closings in November was $183,000. That’s an 11.4% increase from $160,000 in November 2014. It’s also below the Florida median selling price and the national median selling price. The “quiet side of Florida” remains an undiscovered bargain.

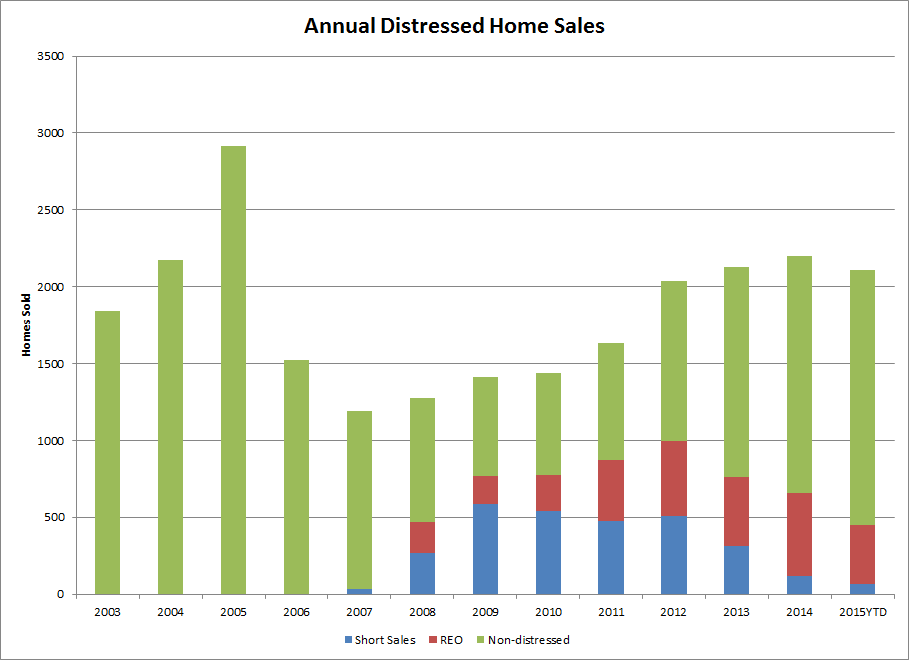

The following chart shows Flagler's entire boom/bust housing cycle:

.png)

As expected, most of the high-value home and condo sales are in the Hammock Dunes DRI; Hammock Dunes, Island Estates, Yacht Harbor Village, Ocean Hammock, Cinnamon Beach and Hammock Beach. More expensive homes sell more slowly in our market, but prices are impressive. Year-to-date (YTD) through November, here is what happened in the Hammock DRI:

- Homes sold = 20

- Median selling price = $582,000

- Price/SF = $204.38

- Homes currently listed = 82

- Absorption rate = 20.5 (meaning that the inventory for sale represents 20.5 months’ worth of sales

Like the Hammock Dunes DRI, Flagler Beach is on the beachside of the Intracoastal Waterway (ICW). The housing mix there is a combination of new construction and older homes. The YTD results for Flagler Beach are:

- Homes sold = 54

- Median selling price = $285,000

- Price/SF = 175.75

- Homes currently listed = 79

- Absorption rate = 5.9

Palm Coast represents the largest market segment in Flagler County. It’s comprised of the original part of Palm Coast, with its “lettered” subdivisions plus communities added later. For example, the gated communities of Grand Haven, Tidelands, Forest Park, Conservatory and Sanctuary are part of Palm Coast. Y-T-D sales in Palm Coast are:

- Homes sold = 783

- Median selling price = $155,000

- Price/SF = $92.99

- Homes currently listed = 629

- Absorption rate = 4.0

New home construction

Through November, 525 single-family building permits were issued within the county. That’s a 6.3% increase over the same period one year ago. Twenty-four separate homebuilders were issued permits during November, two more than last November.

Condominiums

In aggregate sales volume the Flagler condo market is barely 20% the size of the single-family home market. The condo market is bifurcated. The most expensive condos are generally within the Hammock Dunes DRI. Lumping them together can lead to meaningless and misleading statistics. The median selling price for all county condos can be influenced by shift in the mix of units sold within the two market segments.

YTD condo sales results within the Hammock Dunes DRI are:

- Condos sold = 77

- Median selling price = $372,500

- Price/SF = $236.99

- Condos currently listed = 145

- Absorption rate = 20.7

The condo market outside of the Hammock Dunes DRI is substantially different. Sales are much more brisk than in the HD DRI. At this segment’s lower price point, only 5.7 months’ sales are represented by the inventory for sale.

- Condos sold = 229

- Median selling price = $150,000

- Price/SF = $125,75

- Condos currently listed = 118

- Absorption rate = 5.7

Foreclosures

Flagler County’s foreclosure picture continues to brighten. YTD new foreclosure filings are down 26.6% comparted to 2014. Foreclosure completions are down 57.4% over the same period. REO (bank owned via foreclosure) sales represented only 19.7% of homes sold and only 12.5% of aggregate home sales. Of the 852 SFR homes currently listed, only 3.3% are REO. Another 2.1% are short sales.

"Real Estate Matters"

Be sure to listen to my weekly half-hour radio show, Real Estate Matters, every Sunday morning at 9:00 on WNZF News Radio where I discuss a wide range of real estate topics. Listen on 1550 AM or 106.3 FM or streaming live at https://player.listenlive.co/36561. Past shows can be found at https://www.flaglerbroadcasting.com/wnzf/#archives.

Leave a Reply

Want to join the discussion?Feel free to contribute!