Newsletter: Palm Coast Housing Market Still Recovering but Gradually

While locations around the country are reporting declines in housing market activity, Palm Coast and Flagler County continue to recover, albeit gradually.

Palm Coast, FL – October 10, 2014 – Home prices in some areas of the country have recovered to pre-recession levels. The medial home selling price in metro Palm Coast, which includes all of Flagler County, remains nearly 40 percent below peak prices of eight years ago.

While locations around the country are reporting some decline in housing market activity, Palm Coast and Flagler County continue to recover, albeit gradually. Fifty-six new home building permits were issued in September, the highest number since 2007.

Metro Palm Coast led the nation in population growth in the first half of the past decade. Our area’s home prices began to rise before national home prices began to edge up. Palm Coast’s home sales peaked (in June 2005) well before the top of the national market. Local prices dropped more precipitously and further than nearly all other markets.

The local median selling price bottomed out at $106,000 in both September 2011 and in January 2012, seven years after and 59 percent below the peak. More building permits were issued in 2005 than in the next eight years combined.

Palm Coast had a longer climb from the recession’s depth than the national market. Recovery has been steady though. Our housing market reflects many of the patterns seen nationally. Rising prices, fewer cash sales, fewer distressed home sales and fewer new foreclosure filings are all good signs.

The market has shifted. In the past, short sales dominated the segment of distressed home sales. Both locally and nationally, REO sales (foreclosures) now dominate the distressed segment. Only four short sales were reported in Flagler County during September, making that segment statistically insignificant.

The numbers:

| 2014 | % of All | 2013 | % of All | ||

|---|---|---|---|---|---|

| All Flagler Homes | |||||

| Homes Sold | 184 | 100.0% | 154 | 100.0% | |

| Median Price | $150,000 | 100.0% | $149,900 | 100.0% | |

| Ave. $/SF | $95.49 | 100.0% | $89.08 | 100.0% | |

| Total Sales | $35,822,352 | 100.0% | $28,017,692 | 100.0% | |

| Cash | |||||

| Homes Sold | 86 | 46.7% | 74 | 48.1% | |

| Median Price | $136,500 | 91.0% | $149,900 | 100.0% | |

| Ave. $.SF | $86.79 | 90.9% | $88.60 | 99.5% | |

| Total Sales | $15,022,041 | 41.9% | $13.176,775 | 47.0% | |

| Short Sale | |||||

| Homes Sold | 4 | 2.2% | 15 | 9.7% | |

| Median Price | $126,000 | 84.0% | $150,000 | 100.0% | |

| Ave. $/SF | $62.15 | 65.1% | $73.98 | 83.0% | |

| Total Sales | $481,000 | 1.3% | $2,390,600 | 8.5% | |

| REO | |||||

| Homes Sold | 47 | 25.5% | 33 | 21.4% | |

| Median Price | $117,000 | 78.0% | $120,000 | 80.0% | |

| Ave. $/SF | $70.10 | 73.4% | $65.30 | 73.3% | |

| Total Sales | $5.905,976 | 16.5% | $3,899,547 | 13.9% | |

| Non–Distressed | |||||

| Homes Sold | 133 | 72.3% | 106 | 68.8% | |

| Median Price | $163,372 | 108.9% | $165,000 | 110.0% | |

| Ave. #/SF | $105.47 | 110.5% | $98.62 | 110.7% | |

| Total Sales | $29,435,376 | 82.2% | $21,727,495 | 77.5% |

Condominiums

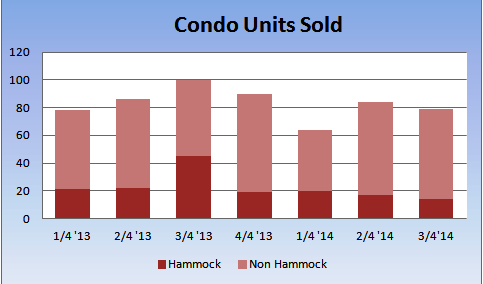

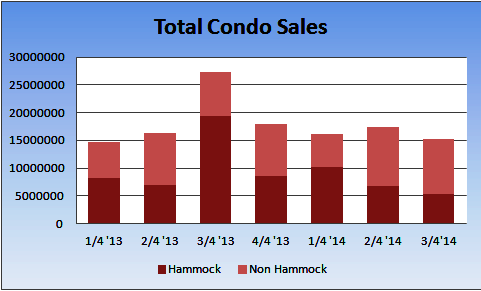

Metro Palm Coast’s condominium market continues to show its two sides. Condominiums in the Hammock (Hammock Dunes, Hammock Beach, Cinnamon Beach and Yacht Harbor Village) dominate the high-end of the market where the third quarter median selling price was $327,500. But Hammock condo sales are tailing off. Only 14 units were sold during the third quarter vs. the 2013 quarterly average of 26.75.

An person close to the Hammock market tells GoToby.com that the "short-term vacation rental" fueled lawsuits in Ocean Hammock and the uncertainty of the Cinnamon Beach Condominium Association’s structural defects lawsuit against the developer have dampened enthusiasm for that market. The same source believes that sale price increases in Hammock Dunes (private with only long-term rentals) encouraged sellers’ expectations beyond what buyers are willing to pay. Twelve Hammock Dunes condominium units are listed above $1,000,000, four of these above $2,000,000. Yet only two sales have closed above $1,000,000 so far this year, the highest being $1,300,000.

Condominium sales outside of the Hammock remain fairly consistent with slightly rising prices. The median selling price for the third quarter was $130,000. The median price for all of 2013 was $120,000. The stacked bar charts below illustrate the marked differences between the two markets.

LInks to popular GoToby.com stories from the past thirty days:

Palm Coast Metro Real Estate Tidbits and Rumors – October 10, 2014

Flagler County Commission Extends Impact Fee Moratorium

Million Dollar Home Built on Wrong Lot in Ocean Hammock, NE Florida (read more than 12,000 times)

NE Florida Eagle Cam Goes Live as Romeo and Juliet Return

Development Order for New Chick fil A Approved by Palm Coast

What Makes Palm Coast and Flagler County So Unique?

Leave a Reply

Want to join the discussion?Feel free to contribute!