Flagler County Foreclosure Filings Down by 41.8 Percent in 2013

Finally, the end is near. New foreclosure filings in Flagler County are down 41.8% from 2013 and 71.0% from the 2009 peak. Foreclosure sales, the final phase of foreclosure, are on the rise.

Palm Coast, FL – January 16, 2014 – There were 41.8% fewer new foreclosure filings in Flagler County during 2013 compared to 2012. New filings were down 71% from the peak levels seen in 2008 and 2009. Meanwhile, foreclosure sales are at an all-time high, reaching 1,000 completed foreclosures in 2013.

A foreclosure sale (auction) is the final step of foreclosure where either the lender or a competing bidder takes title to the foreclosed property. Not all foreclosures filed reach that step though. Along the path, many are either brought current, refinanced, titled back to the lender via a deed in lieu of foreclosure or sold through a short sale. In the years from 2007 through 2010, the number of foreclosure filings (on all property types) exceeded the number of single-family Flagler homes sold via MLS.

The entire foreclosure process takes time, especially in states like Florida that have a judicial foreclosure system. In a judicial foreclosure, the process is under the jurisdiction of the courts which, arguably, give the defendant more protections but take longer. Florida Trend reports that in Sarasota County, the average elapsed time for a completed foreclosure is 999 days. The currently posted foreclosure sale schedule for Flagler County includes a handful of cases filed as early as 2007 and 2008.

As of January 14th, there were 1,455 open foreclosure cases in Flagler County. This compares to over 3,600 in the spring of 2011. Foreclosed homes represent 9.5% of all Flagler MLS single-family homes listed for sale.

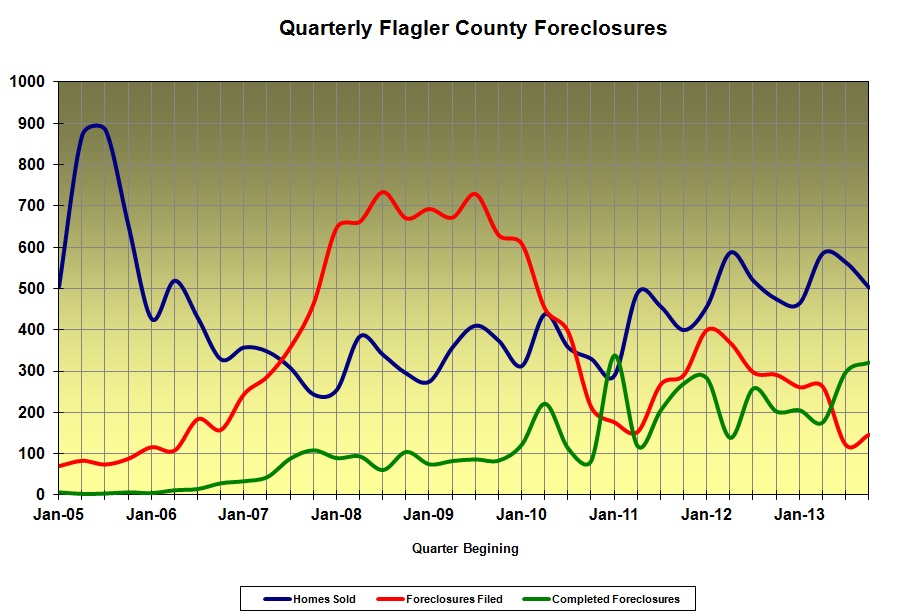

The following chart shows the time relationship between the numbers of homes sold, the number of foreclosure filings and completed foreclosure sales. Home sales plummeted abruptly after peaking in mid 2005 as the housing bubble burst, followed by an upsurge in foreclosures beginning in 2007 and remaining high through 2009. Foreclosure completions are at their highest levels now.

The dip in foreclosure filings in 2011 coincides with the robo-signing scandal. Re-filings with “corrected” documents created a small bubble in 2012. Generally, new foreclosure filings declined steadily since 2010.

Leave a Reply

Want to join the discussion?Feel free to contribute!