2013 Real Estate in Review for Flagler County and Palm Coast

Analysis of the 2013 Flagler/Palm Coast real estate market. Community comparisons. Condominium comparison. 2014 forecast.

Palm Coast, FL – January 10, 2014 – 2013 was a positive year for both realtors and their clients. The inventory of distressed properties continued to shrink throughout the year. For the first time since 2005, prices are on the rise. Single-family building permits doubled from the previous year and builders are complaining about shortages in both materials and skilled labor. Buyers and sellers realized that it was no longer a buyers’ market. That realization fueled competition for desirable (well priced) homes and condos which, in turn, led to price appreciation.

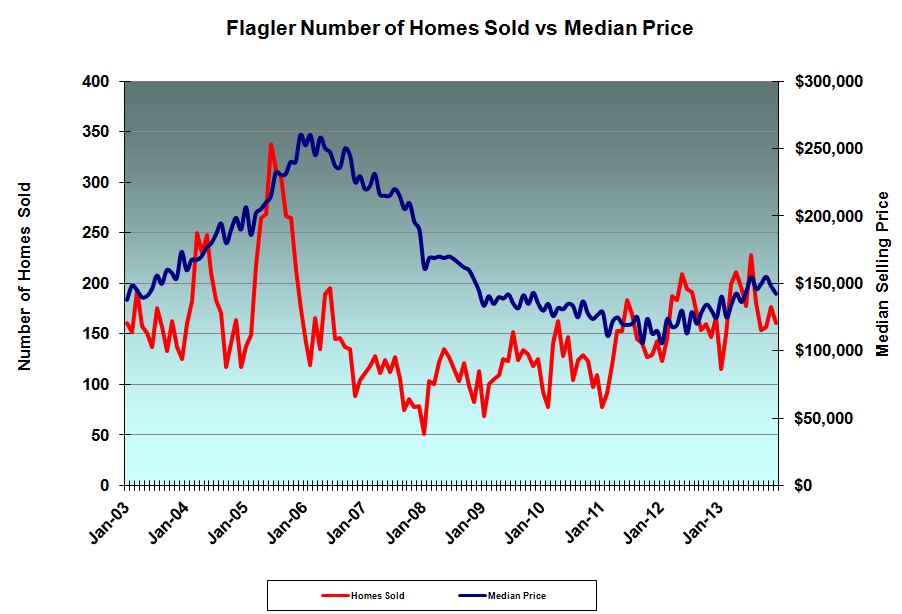

One year ago, I predicted a 15% increase in the number of homes sold. I was way off the mark. The increase was only 3.5%. I predicted that the median price would rise by 5% or more likely 10%. It actually rose 17.9%. Two other predictions; that property assessments would remain essentially flat and that tourism would continue to expand in Flagler County proved to be correct. More homes selling and higher prices combined to increase aggregate sales by 21.4%. That’s a very healthy increase. The following chart illustrates the entire bubble/burst cycle. Note that we are now at about the same level as in 2003.

Source: Flagler MLS

Ten years ago, the number of distressed properties was insignificant. As that number grew, it represented an expanding percentage of all home sales; it depressed the median selling price simply by inflating the number of homes selling “under market value." So both product mix and property value influence the median selling price. The median selling price for non-distressed homes was $146,500 in 2012. It rose to $165,000 for all of 2013, for a year-over-year gain of 12.6%. And it’s still rising. The median price for non-distressed homes in the fourth quarter alone was $170,500.

2013 was marked by several trends, all positive;

- The median price paid for Flagler County single-family homes rose (17.9%)

- Distressed properties became harder to find. In 2012, 48.9% of all single-family home sales were either REO (bank-owned via foreclosure) or short sales. Only 35.9% of 2013 home sales were distressed.

- REO sales now exceed short sales by a ratio of 3:2. Lenders, buyers, sellers and title companies have become proficient processing REO transactions. With good deals becoming harder to find, buyers are less willing to get tied up with a longer and more uncertain short sale selling cycle. Only 6.2% of the current home inventory and 5% of listed condominiums are short sales.

- Local realtors are actively recruiting new agents; another sign of a strengthening market. The aggregate sales price of homes rose by 21.3% and condos by 15.8%. Real estate commissions are based on selling price so aggregate sales growth spins off additional revenue to the realtor community.

- Selling cycles are down. The average Days on Market (DOM) in 2012 was 118 days. It declined to 104 days in 2013. Realtors define DOM as the time from listing date to when the contract is posted as pending.

Median home selling prices ranged from $120,000 in the Belle Terre section of Palm Coast to $623,500 in Ocean Hammock. But homes are selling more quickly in Belle Terre where only about 3.3 months of inventory is available for sale while active listings in Ocean Hammock are equal to 32 months of sales. The number of months’ supply, or absorption rate, measures how quickly homes are being sold with normal being about 6 months. Absorption rates vary even more in the local condominium market where only two months of inventory is available in Tidelands compared to 35 months of inventory in Hammock Dunes.

The following absorption rate table is based on the current inventory and October/November sales.

Flagler/Palm Coast 2013 Absorption Rates

| COMMUNITY | ABSORPTION RATE |

| HOMES | |

| Belle Terre | 3.3 |

| Cypress Knolls | 10.0 |

| Indian Trails | 3.3 |

| Lehigh Woods | 4.3 |

| Matanzas Woods | 8.0 |

| Palm Harbor | 4.6 |

| Pine Grove | 3.2 |

| Pine Lakes | 4.5 |

| Quail Hollow | 4.0 |

| Seminole Woods | 6.5 |

| Grand Haven | 15.1 |

| Hammock Dunes | 10.7 |

| Ocean Hammock | 32.0 |

| All Flagler County homes | 5.7 |

| CONDOMINIUMS | |

| Canopy Walk | 8.0 |

| Cinnamon Beach | 21.3 |

| European Village | 2.0 |

| Hammock Beach | 17.0 |

| Hammock Dunes | 35.0 |

| Surf Club | 7.0 |

| Tidelands | 2.0 |

| All Flagler County condominiums | 7.1 |

Source: Flagler MLS

The extent to which the Great Recession affected different segments of the Flagler/Palm Coast housing market can be seen in the following table comparing 2013 home sales with those of 2006, the year in which the median price reached its peak.

Community Comparison

| Community | Median Price 2006 | Median Price 2013 | % Decline | % 2013 Sales Distressed |

| Belle Terre | $211,500 | $120,000 | 43.26% | 42.86% |

| Cypress Knolls | $306,000 | $185,000 | 39.54% | 39.13% |

| Indian Trails | $229,450 | $129,000 | 43.78% | 38.64% |

| Lehigh Woods | $229,500 | $129,000 | 43.79% | 46.41% |

| Matanzas Woods | $241,950 | $143,000 | 40.90% | 41.54% |

| Palm Harbor | $275,000 | $179,000 | 34.91% | 26.44% |

| Pine Grove | $230,000 | $125,000 | 45.65% | 40.77% |

| Pine Lakes | $246,000 | $141,000 | 42.68% | 35.16% |

| Quail Hollow | $235,000 | $128,250 | 45.43% | 42.31% |

| Seminole Woods | $224,000 | $125,000 | 44.20% | 54.21% |

| Grand Haven | $460,000 | $300,000 | 34.78% | 9.78% |

| Hammock Dunes | $865,000 | $442,500 | 48.84% | 18.52% |

| Ocean Hammock | $847,500 | $623,500 | 26.43% | 25.00% |

| Flagler County | $244,850 | $144,500 | 40,98 | 35.89% |

Source: Flagler MLS

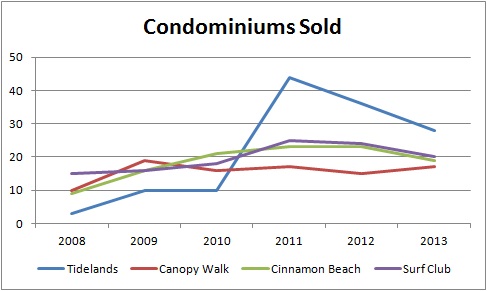

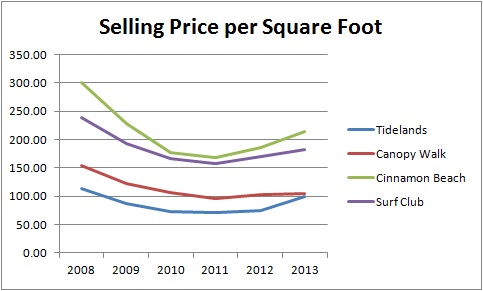

Flagler’s condominiums have shown similar patterns through the recovery with generally increasing unit sales. Only recently have they shown improved price/square foot. The sudden surge in sales at Tidelands beginning in 2011 coincides with “Toby is Moving to Tidelands Condominiums: Anatomy of a Real Estate Decision,” an article I wrote at the time.

Next year:

The positive trend moving into 2014 is well established and should continue unless national or world events intervene. Here is what I expect.

- Home sales (number of homes sold) should increase at a modest pace.

- Median prices will show year-over-year gains in excess of 10%.

- Over 500 single-family home building permits will be issued. Labor and building materials availability will continue to be troublesome for builders.

- The limited supply of condominiums available for sale will put upward pressure on prices. Until the condo market reaches the point where selling prices exceed replacement cost, there will not be any new construction, meaning that it will be at least two years before additional inventory will be available.

- Flagler’s economic development efforts are proving to be fruitful. The arrival of Aveo Engineering "Flagler Lands New Aerospace Company and 300 New Jobs" will become a magnet for other like companies. I expect multiple announcements of recruiting successes in 2014.

- The Matanzas golf course will not be reopened.

- Increases in property values buttressed by the rising real estate market in 2013 will translate to rising property assessments. This will take some of the pressure off belt tightening by local government and school district officials. Budgets will rise but millage rates, offset by increased taxable assessed values, will not.

- New foreclosure filings will continue to drop, but there are still many properties in the foreclosure process. It will take another year or more to flush out this distressed inventory.

Armand Beach Drive

Hi, I follow your column for years now and have respect for your insight. We own a piece of property in the un-incorporated section at 40 Armand Beach Drive. We bought in 2005 at 185,000. Can you tell me when we can realistically see that price again for the property ? It is 10,000 SF.

I see alot of building going on out there in the past year. But I believe that most of those props were sold @ 50,000 or less. Some being distressed and some at 7500 SF. We would like to sell but will most likely build on if prices stay deflated.

Thank-you

Lynn and George Dowson

Armand Beach Drive

Hi, I follow your column for years now and have respect for your insight. We own a piece of property in the un-incorporated section at 40 Armand Beach Drive. We bought in 2005 at 185,000. Can you tell me when we can realistically see that price again for the property ? It is 10,000 SF.

I see alot of building going on out there in the past year. But I believe that most of those props were sold @ 50,000 or less. Some being distressed and some at 7500 SF. We would like to sell but will most likely build on if prices stay deflated.

Thank-you

Lynn and George Dowson

condo prices

hi Toby

I purchased a condo in Bella Harbor in 06 (new) and pay a lot.Bella Harbor has had their share of problems, however most of the issues they had are being addressed and fix. do you see the prices increase and what is your view and option of bella harbor

thanks

george

Savannah Square

i own property in Savannah Square..The tenant currently has a 2 year lease expiring in Dec. 2015. She wishes to purchase the property now, and not at the end of her lease. My question is at what percentage are condos increasing. I am not sure whether to sell now, or wait another year. Thank you..

Phyllis Sherman