Some mortgage servicers may still be waiting for policymakers to offer more carrots to do modifications.

Palm Coast, FL – July 21, 2010

By Selma Lewis, NAR Research Economist

Underwater homeowners have been in the news lately as the foreclosure crisis looms large. In response to the increasing crisis and the lack of a coordinated effort to prevent foreclosures, the federal government has initiated several programs to reduce unnecessary foreclosures. The most comprehensive initiative has been the Making Home Affordable (MHA) program, which is part of the Housing Affordability and Stability Plan (HASP) announced in February 2009. Two key MHA sub-programs are the Home Affordable Modification Program (HAMP) and the Home Affordable Refinance Program (HARP). Also, the latest effort to assist troubled borrowers has been the provision for short-sales and deeds-in-lieu of foreclosure.

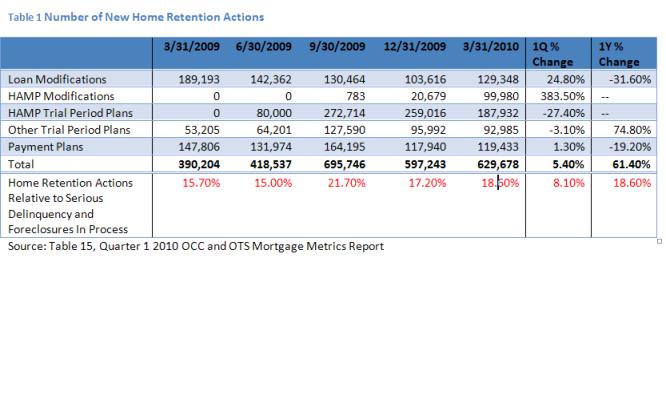

In 2007, modifications were off to a slow start. Although they have increased in the past year, they have not kept up with the pace of delinquencies. The OCC Mortgage Monitor from the first quarter of this year reports that there were 390,204 modifications in the first quarter of 2009. The number rose to 695,746 in the third quarter of 2009 and maintained at 629,678 by the end of the first quarter of this year. However, this only averages about 19 percent of the serious delinquencies and foreclosures in process.

What is the problem? Authors of a series of discussion papers1 point to several issues surrounding modifications. Firstly, modifications have traditionally been costly to mortgage servicers. Because they need to tailor the plan to the individual borrower, the work is time-consuming and requires staff; neither of which can be billed back to the investors. On the other side, foreclosures are deemed less expensive because they do not require working with the borrower and many of the expenses are billable to investors. In practice, in fact, direct “out of pocket” expenditures are reimbursable to servicers, yet the operating costs, such as labor, are not. It is also common for large servicers to provide REO and legal services in separate subsidiaries and can be recipients of these reimbursable costs.

Secondly, there is a lack of clear guidance about acceptable loan modifications. A very large share of subprime and near-prime mortgages that originated in recent years are held in private label mortgage backed securities (MBSs), which are governed by pooling and servicing agreements (PSAs). PSAs require servicers to initiate foreclosures on defaulted loans but provide little to no guidance on dealing with modifications. Although the PSAs vary, generally, they state that the servicer is obligated to maximize the interests of the investors by comparing the net present value (NPV) of a modification to the NPV of a foreclosure. In the case of loans secured by government-sponsored agencies, there are more specific guidelines on how to deal with delinquent loans than there are for private-label securities. But because loans are packed into securities tranches and sold to diverse investors, servicers have to deal with different guidelines, and are concerned about legal liability from unhappy investors, particularly when a modification benefits some inventors at the expense of others. Additionally, some securitization agreements prohibit lenders from contacting borrowers until they are at least 60 days delinquent. This means that lenders cannot contact homeowners who are at risk of going delinquent and offer them more favorable terms until they are already 60 days into delinquency.

Thirdly, servicers have not had the capacity to deal with the sheer volume of the modifications. They did not invest in labor or technology prior to the crisis because the rate of delinquencies in the past did not require such investments. In the midst of the crisis, servicers have been financially constrained given the broader financial crisis and a weak long-term prospect for the subprime industry.

Fourthly, both investors and servicers are concerned with the rate of recidivism, which may ultimately cost them more. Of the over 1 million modifications made in 2008 and 2009, 53 percent were delinquent or in some stage of foreclosure at the end of the first quarter of 2010. More than 41 percent were current and performing, and 1.1 percent were paid off. Of the 587,097 modifications done in 2009, nearly 52 percent were current at the end of the quarter compared with 27 percent of the 421,319 modifications done in 2008. Although, 2009 modifications are performing relatively better than those in 2008, servicers are often said to be reluctant about investing in the process because the modifications are merely postponing the inevitable foreclosures.

Finally, a major obstacle to refinancing and modifications is the presence of junior liens. More than one-third of the subprime adjustable-rate mortgages that originated in 2006 are estimated to have a junior lien present at origination2. Very often, mortgages were split into a senior lien for 80 percent of a property’s value and a junior lien for the remainder. Also homeowners, in many cases, took out a home equity line of credit after originating the senior loan. Credit bureau data suggests that about 30 percent of all mortgages (prime and subprime) currently have an associated junior lien. The share of delinquent borrowers with a junior lien is assumed to be higher.

The problem that modifications present to senior lien holders is that their modified loans might be considered new loans, and thus subordinate to the existing junior liens. The laws on loans subordination vary from state to state. And while this is a legitimate concern for senior lien holders, it is not clear how often such subordinations occur. During the home price appreciation period, junior lien-holders often agreed to re-subordinate their loans when the borrower refinanced the senior mortgage. Nonetheless, because of the legal uncertainties surrounding modifications, senior lien holders generally require the junior lien holder to agree to subordinate their claim to the modified senior lien before agreeing to the modification. But junior lien holders are very slow and reluctant to agree to changes before getting the largest monetary compromise they can because the value of their lien is often worthless in a foreclosure. Consequently, many require some payment from the senior lien holder in order to agree. Many have also started demanding increasingly larger payments in order to agree to re-subordinate. This could be because junior liens are not traditional piggybacks, but it may also be that they are home equity lines with balances of $50,000 or more. Data also suggests that junior liens are less likely to go delinquent than first liens, which gives the junior lien holder no incentive to enter the modification process and take an accounting loss. Why borrowers are continuing to pay their junior mortgage while defaulting on the senior remains a puzzle. Experts wonder if it is due to more aggressive collection by the junior lender, perceived continued access to credit, a smaller payment, or perhaps a combination of the three. All in all, having another party in the already stressful modification process can lead to more lost paperwork and frustration with the process, which are all very discouraging for borrowers. And at the end, some servicers may still be waiting for policymakers to offer more carrots to do modifications.

Given the considerations discussed so far, the pace of modifications has been picking up. According to the first quarter 2010 OCC and OTS Mortgage Metrics Report, during the first quarter of 2010, servicers implemented 629,678 home retention plans, including loan modifications, trial period plans, and payment plans. Table 1 summarizes the number of actions over the past five quarters. The report covers 64 percent of all mortgages outstanding in the United States, so it is not a full modification picture. Nevertheless, servicers initiated 2,731,408 home retention actions in total over the last five quarters. The increase in the number of modifications was largely driven by the increase in permanent HAMP modifications. The drop in the number of trial plans from the previous quarter indicates that servicers have mostly exhausted the pool of borrowers who were eligible for modifications. Accordingly, the number of permanent modifications has increased as many of the trial modifications turned permanent. It also important to note that nearly half of the homeowners unable to enter a HAMP permanent modification entered into an alternative modification with their servicer. Also fewer than 10 percent of cancelled trials move to foreclosure sale. Servicers are claiming, though, that they are modifying many more mortgages than the HAMP program. In a recent hearing by the House Committee for Oversight and Government Reform on HAMP, representatives from five major mortgage servicers testified. They claimed that permanent HAMP modifications represent only about 7 percent of their total modifications. They claimed that somewhere between 70 and 80 percent of HAMP cancellations actually result in some other form of home retention action or avoiding foreclosure. In summary it is difficult to make any conclusion about the HAMP program yet. While the number of HAMP permanent modifications is not at forecasted levels, both HAMP and private label modifications are continuously rising. Also, the mere insistence on mortgage modifications by the government and requirement for servicers to participate in the HAMP program might have driven private labels to reconsider their own proprietary modification programs as well.

1a)Larry Cordell, Karen Dynan, Andreas Lehnert, Nellie Liang, and Eileen Mauskopf “The Incentives of Mortgage Servicers and Designing Loan Modifications to Address the Mortgage Crisis” (forthcoming) in Lessons from the Financial Crisis: Causes, Consequences, and Our Economic Future, Edited by Robert W. Kolb: John Wiley & Sons, Inc., Hoboken, New Jersey, (2010).

b) Larry Cordell, Karen Dynan, Andreas Lehnert, Nellie Liang, and Eileen Mauskopf “The Incentives of Mortgage Servicers: Myths and Realities” in Uniform Commercial Code Law Journal, Spring 2009.

2Larry Cordell, Karen Dynan, Andreas Lehnert, Nellie Liang, and Eileen Mauskopf “The Incentives of Mortgage Servicers: Myths and Realities” in Uniform Commercial Code Law Journal, Spring 2009.

Copyright National Association of REALTORS®, Reprinted from REALTOR.org with permission.

Reality

I am on my second triple expresso at 5am. Let me take a deep breath. In the past year and half, our firm has worked with more than 200 people in this situation (talked to many more) and none have received a mortgage modification. In most cases, the individual gets strung along by the bank (6-9 mo.) talking about a modification and then there is a knock at the door by a process server with a Foreclosure lawsuit in hand. For hundreds of reasons, the industry is not working. Forget HAMP, HAFA, etc. The Fed programs are only for "homesteaded" properties (a small percentage of troubled properties).The Feds and banks refuse to addres the real problem caused by the collapse of the real estate industry…(1)negative equity and (2) a resulting terminally ill residential real estate industry. In 2006, we said it will last until 2009. In 2009, we said it will last until 2011. Today, we are saying it will last until 2013. I am concerned with what we will be saying in 2012. Without the Feds dealing with this negative equity situation, people will continue with strategic foreclosures because it makes no economic sense to pay on something that will never show a return which is the same as burning your money. Setting aside the ethical dicsussions of obligations to repay your mortgage, people will continue to look at their non-homesteaded real estate as an investment which will never show a return and, in fact, will show a significant loss over time (ie, the Conservatory). That is why it is forecasted that foreclosures will continue to rise over the next few years. Staight up, the banks, the Fed, the real estate industry, and "Us", the consumer are all to blame. We all made money during the boom with an intuitive, gut feeling that "this doesnt make sense but I gotta get my peice." Now, the only one who will ever pay to clean up this mess is "Us"..the taxpayer. The banks got bailed out with our money and are now profitting. The Fed is presently using our money, doing great job creating govt agencies, govt jobs, govt programs and, oh yes, new dollars bills. It seems to me that the only one loosing is "Us". "Us" is loosing our equity, our properties to the bank, and our savings. And, "Us" will get dinged again when "Us" has to pay back the trillions of dollars of debt used to keep this insanity going. "Us"… meaning you, meaning people, meaing the people’s children and grandchildren are the ones loosing. This is the Reality….Sorry, I shouldnt have so much coffee. Toby, great site.

RE: Michael Chiumento

Congratulations on summing up reality in one coffee filled paragraph. I whole heartily agree with you and your thoughts.

Now what? How do we (the country) figure a way through this? What makes the most sense for the greater good of everyone?

Modification

We started Oct 2009 with trying to modify our homesteaded home with Suntrust through whom we have our mortgage. We filled out the application and included everything they asked for as we figured this would be better than trying to refi our upside down home. By Dec 2009 they requested additional information which we sent and they said they have all the info they need and now will begin working the application. By Mar 2010, they wanted more pay stubs and we sent it and they said they have it and are now expediting our application as it has been going on too long. End of April, same thing again. End of May, it is being expedited again. End of June, repeat. Here in July, they say that the application time didn’t start until January when they had everything they needed and are now going to re-expedite it as it has been processing too long.

And you wonder why nothing happens. I figured with the incentives outlined in the HAMP where the bank gets additional government funds to modify loans, it would be a no-brainer. But here we still sit and wait for what comes next month.

We have yet been able to speak to the same person twice…….