A First Look at Your 2014 Flagler Property Appraisal Numbers

Preliminary values are posted for your property. Learn the difference between your Just (Market) Value, Assessed Value, Exempt Value, Taxable Value and Portability.

Palm Coast, FL – May 19, 2014 – The Flagler County Property Appraiser gives you a first look at what your 2014 property assessed values might be. These are called “Working Values,” which means “subject to change.” You can check out your values (and your neighbors) at the Property Appraiser’s website,. Here’s what to look for and what the numbers mean.

Based on the Working Values, the final total taxable value of real property in Flagler County is expected to be between 3% and 5% above last year’s total.

I encourage everyone to examine their property records. If you feel that the assessed value (or any other data) is incorrect, do call the Property Appraiser’s office at 386-313-4150. Your calls are welcome because the Property Appraiser wants the information to be correct too. Keep in mind; he does not set your tax rate. That is done by your elected officials. Jay’s job is to fairly and equitably value all property in the county. You should feel that the value assigned to your home is in line with the values assigned to other homes, taking into account differences in size, type of construction, extra features and location.

To find your property record, go to www.flaglerpa.com. You will be greeted on the home page with a picture of what Jay Gardner used to look like. Click “Search Records.” Read the disclaimer, then click “Yes, I accept the above statement.” On the next page, click “Search by Owner Name.” Enter your name (or your neighbor’s) last name first. (If you get “No Records Found,” go back and try your last name only.) The next page will be either your property record or a list of possible records. Identify the property you are looking for and click on its Parcel Number.

Your property record has tons of information, but today, I’ll focus only on the Value Information section. First, look at your property’s Just (Market) Value. This number IS NOT an estimate of what your home is worth if you were to sell it. There are four very important things to understand about Just Value:

- It will likely be lower than what you think your home is worth. That’s because the valuation process adjusts for things like transaction costs (real estate commission, doc stamps, and filing fees). In a stable market, it is typically about 15% to 20% below the real market price

- Assessment numbers are one year in arrears. That means that the 2014 Working Values are based on selling prices from 2013. If the market is going up, as it currently is, the gap between real market price and Just Value will probably be greater. If the market is declining, the gap will be smaller.

- True Value is not affected by homestead status. It truly rises and falls with the market, only with the one year delay previously mentioned.

- Even if you purchased your home in 2013, its Just Value is probably not equal to last year’s purchase price. Just Value is based on a blended analysis of like properties that also sold last year. Some transaction types are deemed to be “unqualified” for value comparison purposes. Bank foreclosures, many short sales, deeds in lieu of foreclosure and non-arms length transactions are among those typically unqualified.

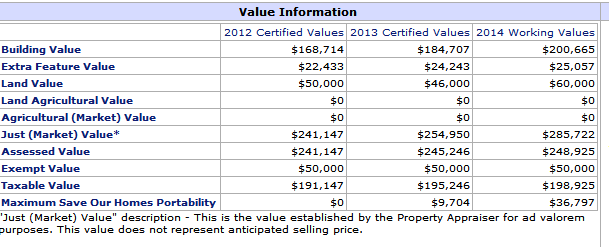

Here’s an example from the record of a Palm Coast home. I’ll step through how to get from Just Value to Taxable Value.

Just (Market) Value: The working Value is $285,722. It is 18.5% above the 2012 Just Value and 12.1% above the 2013 Just Value. That indicates a nice rate of appreciation.

Assessed Value: Florida recognizes Homestead Exemptions when the property is the homeowner’s principle place of residence on January 1 or the current tax year; in this case 2014. Florida’s “Save Our Homes” amendment limits the rate of increase in a homesteaded property’s assessed value to the lesser of 3% OR the increase in the consumer price index. This year, the CPI was the lesser of the two options. In this example, the Working Assessed Value increased only 1.48%.

Exempt Value: The $50,000 in this example is the allowed exemption for a homesteaded property. Other exemptions are available to those qualified; senior, military veteran, etc.

Taxable Value: $198,925 is simply the result of subtracting the Exempt Value from the Assessed Value. This is the number on which your property tax will be calculated by multiplying it by the millage rate. In the example, the taxable value increased 1.85%.

Maximum Save Our Homes Portability (Recently renamed "Protected Value": This represents the difference between Just Value and Assessed Value. You may be able to carry forward all, or a portion, of that difference should you move your homestead to another property in Florida.

Survey: Did the Just Value of your home increase from 2013 to 2014? You can come back to this page later to complete the poll or to check on how other's have responded.

{L}

increase of just title

My just value and assessed value both increased by more than 18%….

Why my home values increased so much comparing to other properties?

Is there anything that I can do?

Your suggestions are appreciated.

Alberto

Reply to Alberto

Your property was homesteaded for several years. That status changed in 2014 to non-homesteaded. Therefore you are not subject to the Save Our Homes limit on appraised value increases. If you think the change in status was an error, call the property appraiser’s office.