11/24/06 – Palm Coast Lot Update

November 24, 2006 – My October 29 th newsletter examined the proposition that Palm Coast Lots (PCL’s) are a good indicator of the Flagler County real estate market. At that time, lots were showing some minor price erosion. But when a local developer told me the other day that they were buying PCL’s for prices in the high $30 thousands to low $40 thousands, I decided to take another look.

PCL’s are the 40,000 lots originally platted by ITT when Palm Coast was born. They make a good statistical indicator because there are so many of them and there is an active market for them. While construction costs can go up or down for several reasons (material, labor, construction code changes, impact fees) these costs are less subject to supply/demand pressures. Lots remain the most variable part of the market value of a home. They are the "pure play". Between 2000 and 2005, the PCL price went from about $5 thousand to about $69.5 thousand last year, a whopping 1300% increase.

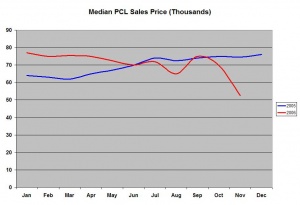

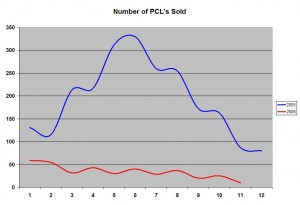

I’m making one change in my analysis this time. PCL’s with saltwater canal frontage represent a small portion of all PCL lots and demand a premium price, skewing the results. Therefore, I’m eliminating them from my analysis this time. The following chart shows the median monthly sales price for PCL’s this year-to-date as well as the number of lots sold. The median price is that price at which half of the sales were higher and half lower. This is a better measure for trend analysis than the average price, which can vary substantially with only one or a few very high or very low prices. The following chart shows the monthly median price for 2005 and 2006. You can see that in June ’06, the price dropped below ’05 levels and remains on a downward trend.

The median price is down, but, as my developer friend pointed out, some PCL’s have sold in the past two months at prices below $40 thousand. Another key thing to examine is the number of PCL’s currently on the market and the PCL’s currently under contract (with a contract for sale but not yet closed). There are 1,687 PCL’s listed today at a median list price of $77.5 thousand ($25 thousand above the November median sales price of $52.5 thousand). Clearly, the majority of the listed lots are overpriced and will languish on the market.

In contrast with the large number of available lots, the number of lots under contract is only 11 and the number sold in November so far is 10. Compare this with the over 300 lots sold in both May and June of ’05. We won’t know the actual selling price of these lots until they actually close and are recorded. But the list price of the pending sales lots is $69.9 thousand – 10% below the average list price of all lots. Clearly, most lots currently listed will not sell any time soon without substantial price reductions. Lacking the pressure of an imbalance in supply and demand, the PCL price should be in line with other available platted but undeveloped lots, called "blanks." Today, this price is in the $40 – 50 thousand dollar range.

In contrast with the large number of available lots, the number of lots under contract is only 11 and the number sold in November so far is 10. Compare this with the over 300 lots sold in both May and June of ’05. We won’t know the actual selling price of these lots until they actually close and are recorded. But the list price of the pending sales lots is $69.9 thousand – 10% below the average list price of all lots. Clearly, most lots currently listed will not sell any time soon without substantial price reductions. Lacking the pressure of an imbalance in supply and demand, the PCL price should be in line with other available platted but undeveloped lots, called "blanks." Today, this price is in the $40 – 50 thousand dollar range.

By: Toby Tobin

Leave a Reply

Want to join the discussion?Feel free to contribute!