Two Land Sales in Palm Coast Park Total Nearly 1,500 Acres

4,700-acre Palm Coast Park stretches along both sides of U.S. 1 from roughly Hargrove Grade to Old Kings Road. It was planned in the early 2000s by Palm Coast Holdings on behalf of Allete Properties.

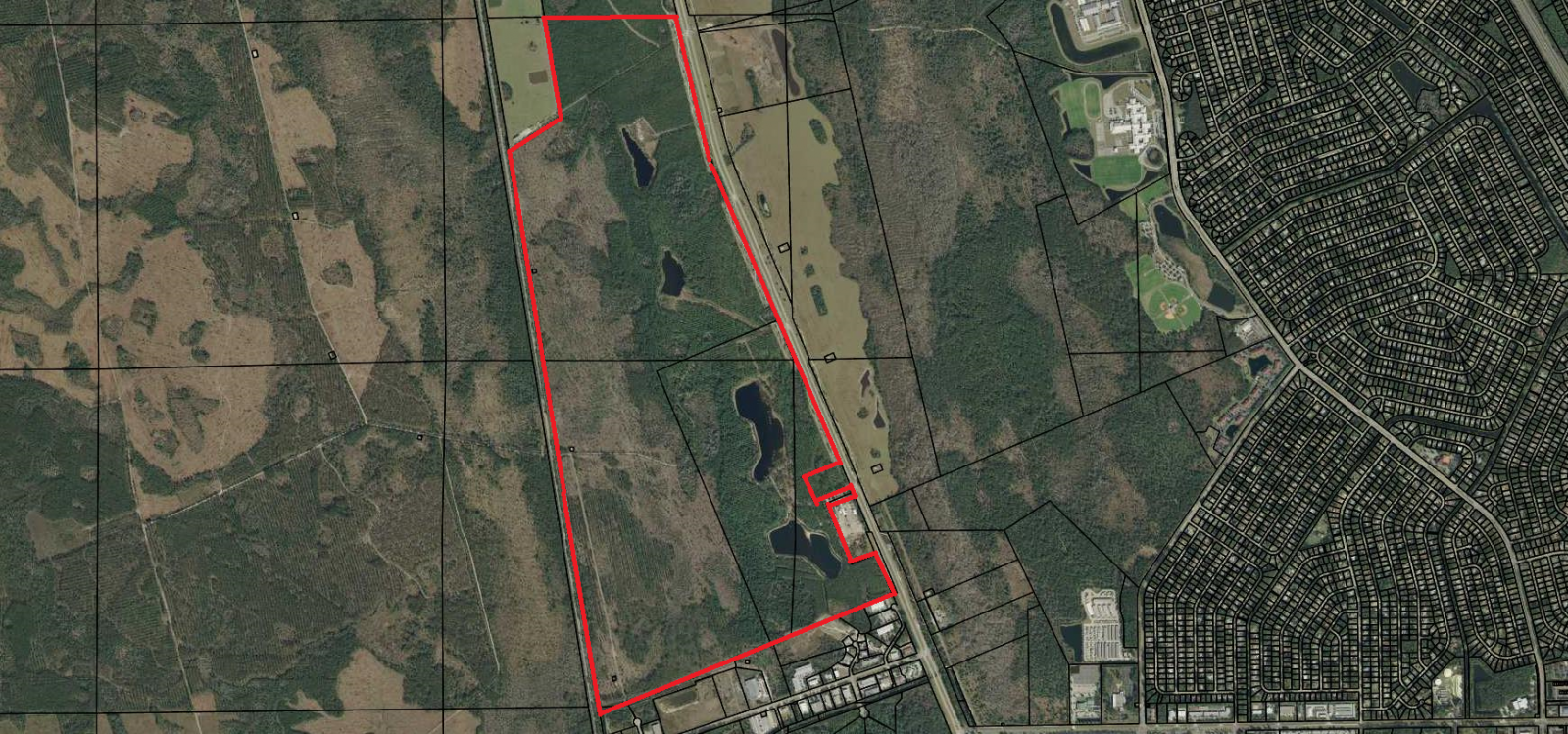

PALM COAST, FL – August 24, 2017 – With two separate transactions, Palm Coast Land LLC (Allete Properties) has closed on nearly 1,500 acres of land in Palm Coast Park, a 4,700-acre mixed use Development of Regional Impact (DRI) straddling U.S. 1 from roughly Hargrove Grade to Old Kings Road. The parcels, when developed, will include approximately 1,400 residential units

In the first transaction, Optimum Global Properties LLC, of Orlando, purchased Parcel 5 of the DRI, consisting of nine contiguous plats (separate tax ID numbers) totaling approximately 700 acres. Parcel 5 is bounded by U.S. 1, Old Kings Road, Interstate 95 and the former Matanzas Golf Course (shown in the upper-left corner of the map). It is designated in the master plan for up to 644 single-family homes.

The Just (Market) Value of Parcel 5 is $3,663,823. The sale closed June 27, 2017 for $1,750,000, or $2,717 per residential entitlement.

In the second transaction, Florida Land Investments I LLC, of Charlotte, N.C., purchased Parcels 1, 2, and 3 for $1,500,000. The three parcels consist of six separate tax IDs totaling 790 acres. The development master plan classifies Parcel 1 as high-density residential, suitable for either multifamily or single-family dwellings totaling 380 residential units. Parcel 2 is designated as medium-density residential while Parcel 3 is low-density residential. Parcels 2 and 3 combined are entitled for 400 single-family units.

This transaction closed August 14, 2017 for $1,500,000. The Just (Market) Value for the combined Parcels 1, 2, and 3 is $5,955,496. Of the 790 acres, only 165..58 are useable. Parcels 1,2 and 3 are located in the lower right corner of the site plan map above. The image below is from the Flagler County Appraisers website. The affected parcels are outlined in red.

Florida Land Investments purchase (from Flagler County Appraisers website)

Both Palm Coast Park, and its sister DRI, Town Center, are vestiges of the early 2000s when the local real estate market was anything but “real.” Speculation abounded, driving expectations and land prices to unsustainable levels. Early this year, Allete Properties closed their Palm Coast Holdings office and brought in Douglas Property and Development and Maury L Carter & Associates to reposition their Flagler County properties and to manage their disposition.

The rapid repositioning and early resales successes reinforce the vitality of the local market – provided that the pricing is right. Several other properties in Town Coast Park, both residential and commercial, are said to be under contract.

GoToby,com wrote an article in January about Allete closing Palm Coast Holdings. The information and analysis in the article are still relevant today, so I repeat the article below. You can click on the headline to see the original, which includes links to several related stories.

Palm Coast Holdings Closing Palm Coast Office

PALM COAST, FL – January 31, 2017 – Palm Coast Holdings, successor to ITT and developer of Town Center and Palm Coast Park, will close their office permanently on March 31, 2017. The decision was made recently, and unexpectedly, by Palm Coast Holding’s parent company. Seven employees will be affected. Going forward, Allete’s Florida assets will be managed for sale by the Carter Douglas Company.

Palm Coast Holdings is controlled by Allete Properties LLC, a wholly owned subsidiary of Allete, Inc., a Duluth, Minnesota based company that also owns Minnesota Power which provides electric utility service to northern Minnesota.

In 1996, the company first acquired property in Flagler County from ITT, including developed residential lots, developed and undeveloped commercial and industrial parcels and approximately 13,000 acres of agriculturally zoned property. In 1999 and 2000, the company acquired an additional 6,800 undeveloped acres in Flagler County and in 2001, it acquired another 6,400 undeveloped acres in Flagler County and Volusia County.

Palm Coast Holdings disposed of the residential lots and concentrated on planning, entitling and site development of large commercial and mixed-use developments, primarily Town Center and Palm Coast Park. Both projects were stalled by the real estate crash a decade ago. By 2009, Palm Coast Holdings was informed that Allete would make no further investments locally.

Palm Coast Holdings began efforts to sell local assets, which by this time, also included two Volusia County assets; Ormond Crossings, an expansive multi-use master planned community straddling Interstate 95 south of US 1 and a 1,890-acre wetlands mitigation bank (Lake Swamp Mitigation Bank). Ormond Crossings was titled under Tomoka Holdings LLC, another Allete subsidiary not to be confused with Consolidated Tomoka Land Company.

Efforts to sell were hampered by the high book value of the assets until 2015, when Allete wrote down the assets by $50M. Both Volusia County assets were sold in 2016, reducing Allete’s local assets by about 50%.

Allete created several subsidiaries in Flagler and Volusia Counties. Palm Coast Holdings is the brokerage arm and holds some land in Town Center. Other subsidiaries’ primary role is to hold assets. Among them are Florida Landmark Communities LLC, Palm Coast Land LLC, Allete Commercial and Tomoka Holdings.

Town Center

Town Center is a 1,557-acre mixed-use master planned development begun more than ten years ago. Development of Town Center stalled with the onset of the Great Recession and accompanying real estate crash. However, several perimeter sections have been successfully developed. Healthcare and elderly care facilities dominate Town Center's east side, "big box" retail (anchored by Target) occupies the southwest section (at Belle Terre at SR 100), and a Publix-anchored plaza on Belle Terre thrives at the west entrance to Town Center.

An Epic Theater, a large commercial office building, and a charter school were lonely sentinels in the project’s interior until joined by Palm Coast’s new City Hall in 2016. Regional builder ICI Homes has put several residential Town Center parcels under contract. These parcels will likely be developed as town homes, row homes or patio homes. The additional rooftops will likely spur renewed commercial development in Town Center.

ORIGINAL TOWN CENTER MARKETING VIDEO

TOWN CENTER FROM GOOGLE EARTH

Palm Coast Park

Palm Coast Park consisted of 4,700 acres on either side of US Highway 1 between Palm Coast Pkwy and Old Kings Rd. Like Town Center, Palm Coast Park is a mixed-use master planned community. Anyone driving along this stretch of US 1 will notice the multi-use paths with attractive wooden walkovers wetlands on either side of the highway, but little else. The project is primed to take advantage of the projected commercial development expected over the next five to ten years along the US 1 corridor.

ORIGINAL PALM COAST PARK MARKETING VIDEO

Remaining holdings

Allete has substantial commercial and residential-entitled holdings between Colbert lane and Roberts Road and along Seminole Woods near the Flagler Executive Airport.

Analysis

While painful for the affected employees, upcoming changes will likely have a positive impact on Flagler County. Allete’s exit is not based on a fundamental weakness in the local economy going forward. The decision was made by an out-of-state company that has not visited Palm Coast in years.

Ironically, it is not the first time an energy company's subsidiary has left Flagler County. Landmar Group, purchased Grand Haven from Lowe Development at the turn of the century. They subsequently purchased three local golf courses (The Grand Club) and began to develop Grand Landings, a residential development south of the Flagler County Executive Airport. Landmar was a subsidiary of Crescent Resources, the real estate arm of North Carolina-based Duke Energy.

Before Landmar and Crescent Resources were forced into bankruptcy by the real estate crash, Duke divested itself of 51% of Crescent Resources. Why? Because the real estate company had been too profitable. It was upsetting Duke Energy’s income statement and therefore placing Duke Energy’s classification as an “energy” company at risk. A change in classification would have negatively affected Duke’s ability to sell bonds. Hence the divestiture. We may never know what was behind Allete’s decision.

Real estate investors are used to seeing developers come and go through the life of a large project. Over the life of Palm Coast, there have been several ups and downs, though none like the Great Recession. Investors’ capital either gains leverage or loses leverage as the business cycle rises and falls. These fluctuations are predictable, like death and taxes, but their timing is not.

GoToby.com believes that Flagler County’s economy and its real estate market have moved into a very positive phase, one likely to last three to five years or more. This new growth will be driven by end-user residents, the products of a steadily growing population, rather than the speculators that spawned the housing bubble.

Palm Coast Holding’s successor will benefit for two reasons; 1.) Their timing will be excellent, and 2.) Their cost basis will be lower than Allete’s, giving them an opportunity for substantial return on their investment. Think of it as turning over old, tired capital in favor of new, fresher capital, not unlike the way farmers plow last year’s crop under to enrich the soil to nurture next year’s crop.

Palm Coast Holdings took Palm Coast to the next level while honoring ITT's vision. They were good stewards of the land. Most importantly, they did not bail out when things got tough. My hat is off to them.

Leave a Reply

Want to join the discussion?Feel free to contribute!