Study: U.S. Needs 3.3M More Homes to Satisfy Demand

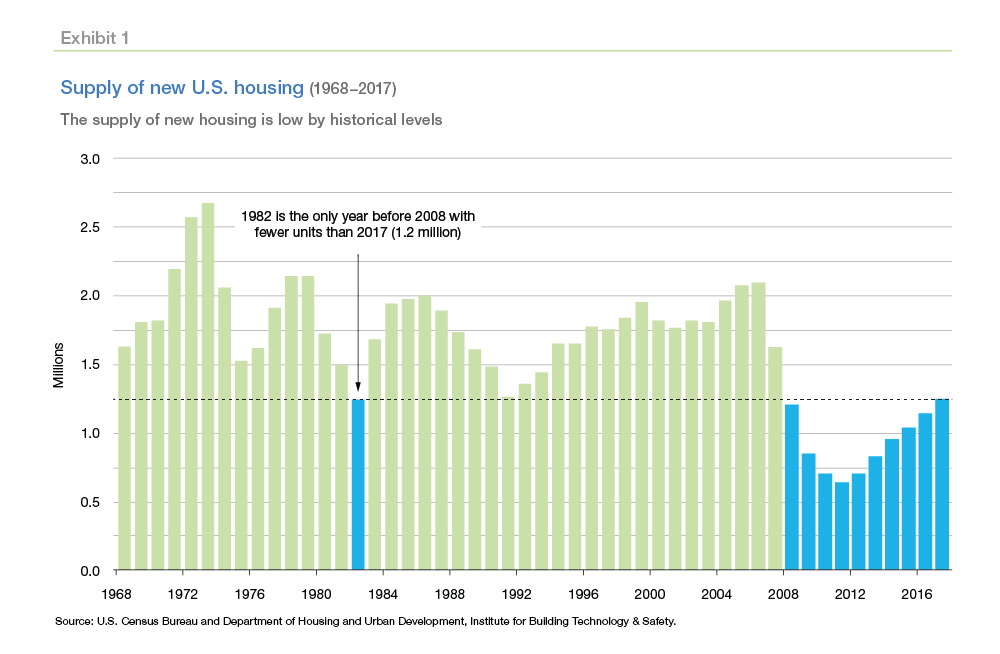

Buyer demand remains strong, but years of underbuilding has created a huge deficit, particularly in states with strong economies that attract people from other states.

Years of underbuilding has created a large deficit, particularly for states with strong economies that attracted people from other states. Their construction deficit has partly sparked more Americans to move to more affordable interior states, which now need to build more housing units in order to accommodate growing populations.

“We are in the midst of a demographic tailwind, and we expect home purchase demand will remain strong well into the next decade as the peak cohorts of millennials turn thirty years of age in 2020 and beyond,” says Sam Khater, Freddie Mac’s Chief Economist.

“Simply put, new housing supply is not keeping up with rising demand,” says Khater – a point echoed by the National Association of Realtors® (NAR). “We estimate that the housing market is undersupplied by 3.3 million units, and the shortage is rising by about 300,000 units a year.”

Khater says that more than half of all U.S. states have a housing shortage, and the shortage is no longer concentrated in coastal markets as it spread to the middle of the country in more affordable states like Texas and Minnesota.”

Insight highlights

- We estimate that there are 29 states with a housing supply deficit, and when considering only these states, the United States housing supply shortage grows from 2.5 million units to 3.3 million units.

- Excluding the District of Columbia, Oregon has the largest housing supply deficit followed by California, Minnesota, Florida, Colorado, and Texas. We estimate that 21 states have a negative deficit, meaning they are oversupplied.

- Domestic migration is worsening the housing shortage issue in some states. In pursuit of new opportunities in states with stronger economies, people have migrated from states with surplus housing like West Virginia, Alabama and North Dakota, to states with housing deficits, putting pressure on high-growth states.

- States with stronger economies like Oregon and California have historically attracted residents seeking opportunities. However, they have a much lower supply of housing units compared to their historical averages. The supply shortfall is driving up prices and causing their largest cities to become less affordable.

- The housing shortage is causing demand to increase in more affordable interior states with stronger economies, causing states such as Texas, Colorado, and Minnesota to experience a supply shortfall.

- While there are many reasons for the constrained supply, zoning regulations are the most binding location-specific reason for the housing supply shortage. States like California, Washington and others have undertaken policy action to address this issue.

- The housing undersupply is not only large and growing but will be exacerbated as millennials and Generation Z enter the housing markets to form their own households this decade. It means housing demand will continue to rise throughout the decade, putting upward pressure on prices and causing affordability to continue to worsen.

© 2020 Florida Realtors®. All rights reserved. Reprinted with permission.

FROM THE STUDY

Leave a Reply

Want to join the discussion?Feel free to contribute!