Expiration of Tax Credits dulls residential market. In spite of lending limits, condo market sales are up reflecting the increased number of distressed properties in that sector.

Palm Coast, FL – September 7, 2010 – As GoToby.com predicted, the increase in the number of distressed condominiums has buoyed sales in that sector of the Palm Coast, Flagler real estate market. [GoToby.com defines distressed properties as those that are lender-owned, either through foreclosure or a deed in lieu of foreclosure, and short sales.] The increased sales volume predictably comes as a result of lower prices.

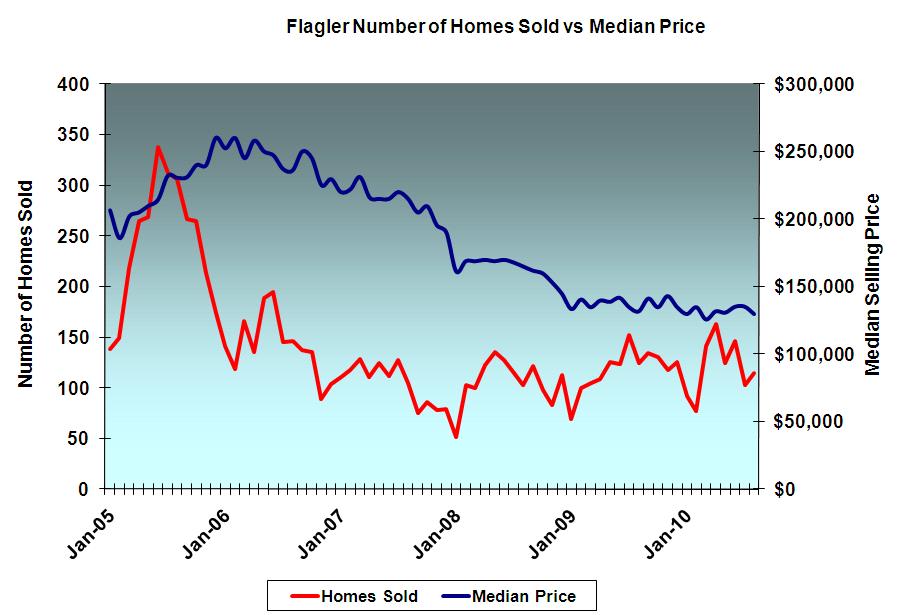

Single-family residential home sales were down in both July and August, but not as much as in other parts of the country. Local selling prices continue to hold up rather well compared to national statistics. The monthly median selling price for single-family residential homes sold through MLS in Flagler County has held within a narrow band between $126,000 and $135,350 this year. July and August median selling prices were $135,000 and $130,000 respectively.

Median price/square foot continues steady at just below $70.00. This is below replacement cost, so there are plenty of buyers for those homes that are priced properly. Unfortunately, the inventory of homes for sale reflects a resistance by sellers to meet market pricing. There are 1,394 homes listed on MLS; median list price = $195,000 and median price/square foot = $101.00. Some of the discrepancy is due to the heavy proportion of unsold upscale homes listed. 50% of listed homes are priced above $195,000. Yet only 22.8% of homes have sold this year for $195,000 or more.

Having hit bottom, Palm Coast’s residential sector will likely bounce along until the supply of distressed properties diminishes (as long as it is unencumbered by outside influences). There is currently about a one-year supply of homes on the market given today’s prices and sales volume. Monthly sales whittle down the supply while additional foreclosed properties and short sales come onto the market.

But outside influences are always a possibility. In spite of protestations from Washington, the general economy is not showing signs of recovery. I hear anecdotal evidence daily that the already long duration of this great recession is wearing even on those who entered it with what seemed like adequate financial reserves.

The most dramatic shift has been in the condominium market. The single-family residential sector began gaining sales momentum a couple of years ago when foreclosures began bringing lender-owned properties onto the market. Lenders, unaffected by emotion, quickly found the price point for which buyers had been waiting. The same phenomenon has occurred in the condo market. Distressed condominiums represent 32.1% of the available inventory, nearly the 34.0% proportion of the single-family residential sector.

Notice the trend in the following chart. Clearly prices are affected by the growing supply of distressed properties; resulting in increased sales. Hammock Beach Tower units are selling for less than half their original list price and still loaded with incentives. But they are selling.

Palm Coast/Flagler Condominium Sales

| |

Condos Sold

|

Median Sale Price

|

Median $/SF

|

|

1st Qtr ’09

|

40

|

$307,250

|

$190.28

|

|

2nd Qtr ’09

|

45

|

$225,000

|

$158.89

|

|

1st Qtr ’10

|

61

|

$154,000

|

$126.49

|

|

2nd Qtr ’10

|

80

|

$140,000

|

$117.00

|

|

Jul/Aug ’10

|

57

|

$225,000

|

$162.00

|

Condominium Financing Availability Affects Pricing

Major banks lack liquidity. They need to sell their mortgages to Fannie Mae or Freddie Mac. Fannie and Freddie’s multi-page qualification questionnaires pretty much eliminate most of Florida’s condo market. Among other things, they examine the percentage of units carrying delinquent in assessments, the financial strength of the condominium association, the association’s reserves, their insurance policies, rental policies, etc.

The lack of traditional mortgage financing in the condominium market limits the buyer pool to those with cash, private financing, or non-traditional loans. The result is limited demand for condominiums. When demand drops, prices do as well. The condo market is at the opposite of whatever irrational exuberance is.

According to John Lynch of Coastal Lending Services, loans are available but not in the traditional 30-year fixed flavor. Buyers should expect to put down a larger down payment, typically 25%. Loan types are likely to be limited to 3-year and 5-year ARMs or 15-year fixed rate mortgages. Rates can be found in the mid 4% to low 5% range for well qualified buyers.

Cheri Campbell of BB&T agrees. She attributes some of the problem to the way condominium communities market themselves. Any reference on their website or in their promotional material to short term, weekly, or daily rentals triggers Freddy and Fannie to disqualify the units as "condo/hotels," even though they are not. This applies to ads run by individual unit owners too. Cheri reports that Canopy Walk seems to be in a stronger position. She has a "traditional" loan for a unit closing there within the next week. This may account for the difference in the median listing price for Canopy Walk units ($130.00/SF) vs. Tidelands ($117.00/SF). Both condominium communities border the Intracoastal Waterway.

The best time to buy condos coincides with the worst time to get a condo purchase loan. Buyers with financing available who are willing to do their homework (due diligence) and accept greater risks will find great condo bargains. Most are selling well below their intrinsic value. One Intracoastal Waterway Tidelands unit recently purchased on a short sale for $175,000 was acquired only a few years ago for $565,200 (off 69%). A Yacht Harbor Village unit, also on the Intracoastal, originally acquired for $789,000 recently sold for $189,000 (off 76%). While riskier than single-family homes, I believe condominiums have a greater upside potential.

Foreclosures and foreclosure sales

The number of foreclosure filings in Flagler County is dropping as the number of foreclosure sales increases. Foreclosure filings, foreclosure sales, and tax deed sales continue to include a noticeable of high-end properties.

July/August foreclosure filings include:

-

Armand Beach Estates – one home

-

Bella Harbor – one condo

-

Canopy Walk – one condo

-

Cinnamon Beach – one condo

-

Conservatory – four lots

-

European Village – 2 condos

-

Gardens at Hammock Beach – one lot

-

Grand Haven – two homes, one lot

-

Hammock Beach – four condos, one lot

-

Harborside Village – four condos, three lots

-

Hammock Dunes – three condos, one home

-

Marina Bay – one condo

-

Marina Cove – three condos

-

Ocean Hammock – one home, one lot

-

Palm Coast Plantation – one home, one lot

-

Sanctuary – one lot

-

Sugar Mill Plantation – one home

-

Tidelands – five condos, one lot

Become a Member of GoToby.com: Receive email notices of news, rumors, newsletters, and articles. [click here] It’s free.

Leave a Reply

Want to join the discussion?Feel free to contribute!