Palm Coast and Flagler 1stQ Real Estate Analysis

Short sales no longer a factor. REOs are declining as a percentage of all sales. Cash sales are down slightly. Inventory is down 8.9%. Generally, the market continues to get healthier.

Palm Coast, FL – April 21, 2015 – As some parts of the country are talking about a housing market slowdown, the Flagler County and Palm Coast housing market continues to plug along in positive territory by all measures.

Single-family Homes

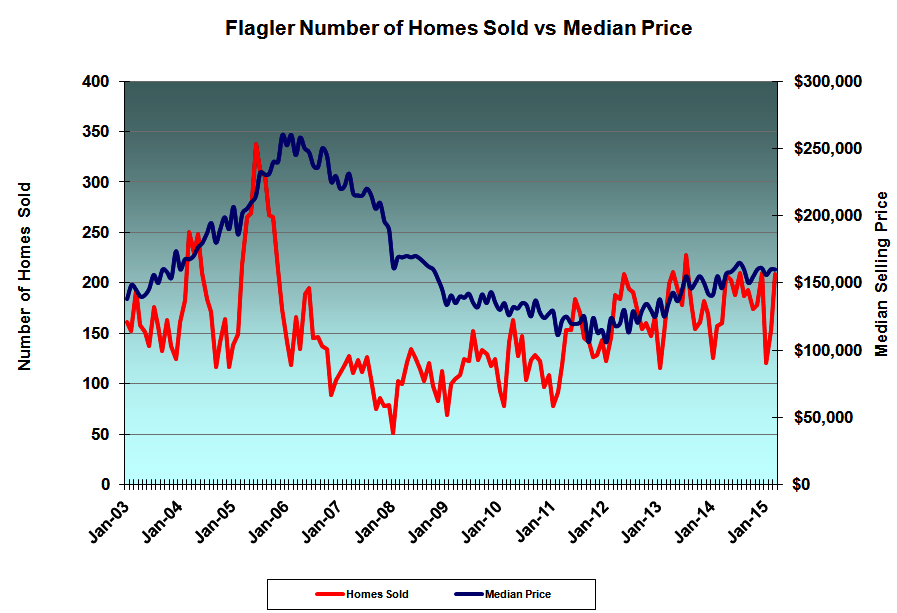

- The first quarter of 2015 saw 483 Flagler County single-family homes sold through Flagler’s Multiple Listing Service (MLS). That’s a 9.0% increase from 2014’s first quarter.

- The median selling price of homes sold in the first quarter of 2015 was $160,000, up 9.6% from one year ago.

- 46.6% of homes sold in the first quarter of 2015 were cash sales, down from 49.4% one year ago.

- Only 20 first quarter home sales were short sales, representing 4.1% of all sales. They sold at a median price of $120,000 and made up only 2.3% of the aggregate sales value. Only one short sale closing has been reported during April (through mid-month).

- REO (or lender-owned) sales are gradually declining, representing 23.4% of homes sold vs. 30.5% in the first quarter of 2014. REO median selling prices are discounted 21.6% from non-distressed median selling prices.

- Distressed homes comprise only 9.1% of all current listings.

- Non-distressed home sales (350) were up 29.2% in the first quarter compared to 271 non-distressed sales last year (1stQ). Yet the median selling price for non-distresses rose only 1.2% year-over-year. This indicates that most of the overall 9.6% median price increase was caused by the shift in sales mix. Non-distressed sales were up and distressed sales down.

- While non-distressed homes comprised only 72.5% of the homes sold in the 1stQ, they accounted for 80.3% of the dollar volume.

- 131 single-family home building permits were issued 1stQ, up a mere 3.1% from one year ago.

- The inventory of single-family homes listed for sale is down 8.9% year-over-year. Based on the average number of sales over the quarter, today’s inventory represent slightly less than 6 months of sales. This number is also referred to as the absorption rate. This is generally considered a healthy normal market.

Segmenting the market gives a truer picture. The real action is at the lower segment of the market; homes under $200,000. Only 313 homes are listed for less than $200,000, but an average 111 per month are sold for less than $200,000. The absorption rate in that segment is a very low 2.8.

Foreclosures

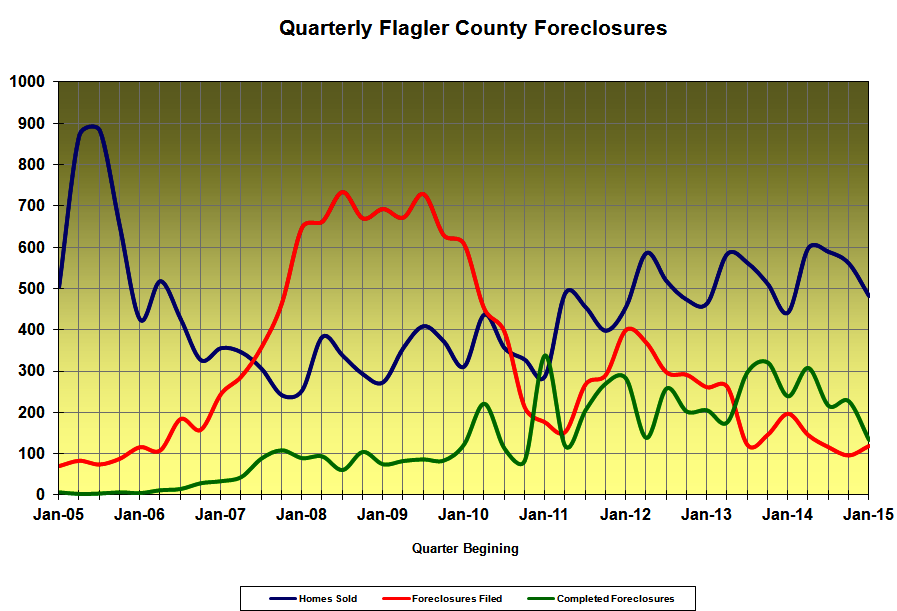

- All measures of foreclosure activity are headed in the right direction.

- 119 new foreclosures were filed in the 1stQ, down 39.6% year-over-year.

- 133 foreclosures were completed, compared to 239 in the same period one year ago representing a 44.4% decrease.

- There are 685 open foreclosure cases in Flagler County, down from 997 only eight months ago.

Leave a Reply

Want to join the discussion?Feel free to contribute!