Newsletter: Flagler and Palm Coast Home Sales Continue to Gain Strength

May was very positive with more homes sold, higher median prices, fewer distressed sales, fewer new foreclosures, fewer foreclosure completions and more building permits for new homes.

PALM COAST, FL – June 17, 2015 – The positive trend in the Flagler County real estate market continues with fewer distressed sales. Short sales comprised 41.5% of all local single-family home sales in 2009. That measure dropped to 1.9% in May. May was very positive with slightly more homes sold, higher median prices, fewer distressed sales, fewer new foreclosures, fewer foreclosure completions and more building permits for new homes.

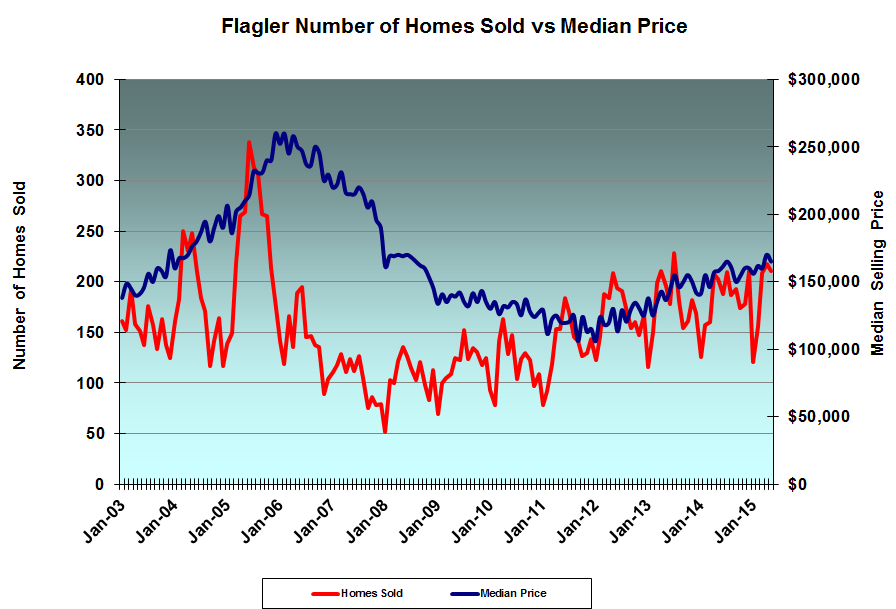

Homes sold

May home sales (211) were in line with March (209) and April (214), up 3.9% from May 2014 (203). Year-to-date numbers are more statistically significant. YTD home sales (914) are 7.0% above the same period one year ago (854). At the local markets low point for the number of homes sold, only 550 homes were closed during the first five months of 2007.

Median selling price

The median price of May home sales ($165,000) was also in line with March ($160,000) and April ($170,000). The median price for homes sold in May 2014 was $158,000. YTD numbers are again more statistically convincing with the 2015 YTD median price being $161,950 vs. $152,000 for the same period one year ago. During the first five months of 2012, the year local home prices bottomed out, the median selling price was $119,000. So median prices have recovered 36.1% over the past three years.

Keep in mind that the median price increase is not only due to increased home values but also to the change in the selling mix. Between 2009 and 2011 more than 50% of all homes sales were distressed. That contribution has dropped to 21% YTD.

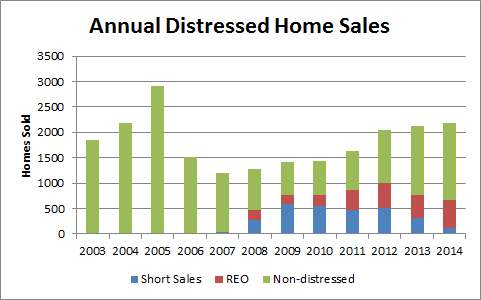

Short sales

This is probably the last year I will be measuring short sales as a separate category. May short sales accounted for only 1.9% of all home sales. The total value of all short sales (there were only four) comprised only 1.3% of the total home market. Only 2% of the 901 homes currently listed for sale are short sales.

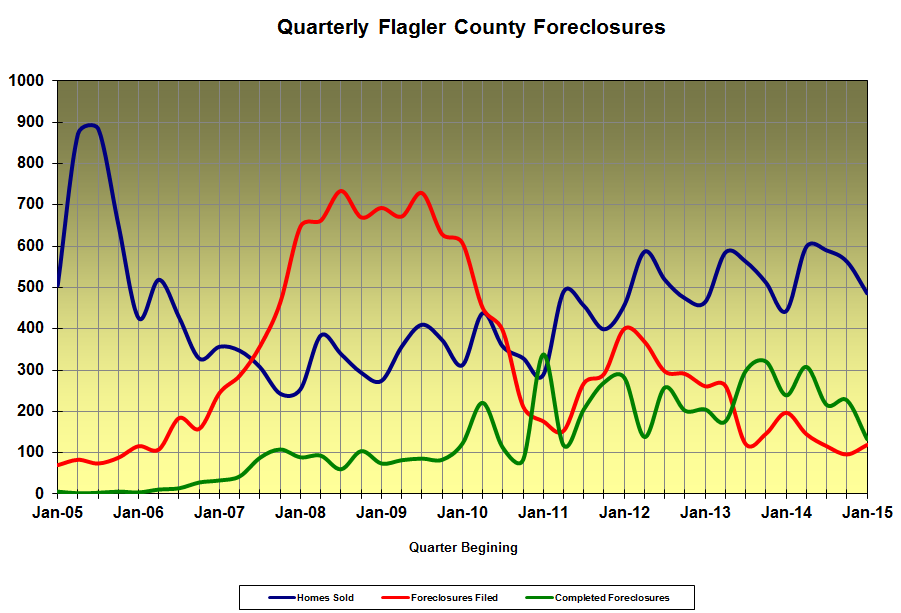

Foreclosures and REO sales

Foreclosures are “completed” after a final judgment is issued and the property is sold at a foreclosure auction, either to the lender or to a competing private bidder. Once a lender takes title to the foreclosed property, it is classified on their balance sheet as Real Estate Owned (REO). Hence the REO sales category.

REO sales are trending downward slowly. At their peak, they were over 24% of the total home sales in 2011, 2012 and 2014. REO sales have dropped below 20% for the past two months. REO sales are feed by the flow of foreclosure completions. There have been fewer than 40 new foreclosures and fewer than 40 foreclosure completions in each of the past two months.

Local foreclosures peaked during 2008 and 2009 with an average of more than 225 new foreclosures per month. 2013 and 2014 were the peak years for foreclosure completions, averaging more than 80 per month. There are currently only 625 open foreclosure cases (for all properties) in Flagler County.

Normal (non-distressed) sales

Prior to the housing bubble, non-distressed sales were the norm. There was no need to separate them because short sales did not exist and REO sales were inconsequential. The most accurate way to compare today’s market prices to those before the collapse is to focus on normal sales. Normal sales have grown from being in the minority to dominating the market. Normal sales represented 79.1% of all May Flagler County home sales and fully 83.8% of total home sales value.

The median price for normal sales in May was $177,500, nearly equal to the YTD $177,750. However bright that picture seems, we are still 31.6% below Flagler’s all time high of $259,950. Of course, Flagler’s peak level was anything but normal.

Absorption rate

Overall, the county’s absorption rate stands at 4.3%, meaning that there is only 4.3 months of inventory (listed for sale) at today’s selling prices. This represents a fairly strong sellers’ market. But absorption rates typically vary from market segment to market segment.

The biggest difference in absorption rates is apparent between different price points. For instance, there is a significant difference between properties within the Hammock Dunes, Hammock Beach and Ocean Hammock area, also known as the Hammock Dunes Community Development District (HDCDD). Higher priced properties do not turn over in the market as quickly as lower priced alternatives.

YTD, 32 condominiums have sold within the HDCDD at a median price of $368,750. With 153 condos on the market within the HDCDD, that puts the absorption rate at 23.9. Conversely, there are 131 condos listed for sale outside of the HDCDD. YTD, 97 have sold with a median selling price of $130,000. The absorption rate in this market segment is only 6.8.

The same is true in the single-family home market. Here are three representative home market segments:

- HDCDD – Only 20 homes sold during the first five months of 2015 with a median selling price of $582,000. Currently listed are 82. The absorption rate is 20.5.

- Flagler Beach – A total of 54 home sales closed YTD with a median price of $285,000. With 79 Flagler Beach listings, the absorption rate is 5.9.

- Palm Coast – The Palm Coast market moved 783 homes YTD with a median price of $155,000. With 629 homes currently listed, the absorption rate is a very healthy 4.0.

New construction

Building permits for 232 single-family homes have been issued YTD, up 11% over last year’s count at this time. This is a nice increase, but less than the 25.6% increase in the total 2014 permits over the 2013 total.

* Listen weekly to "Real Estate Matters" with me and co-host David Alfin every Sunday on WNZF News Radio right after the 9:00 A.M. news break. 1550 AM or 106.3 FM. Or streaming live worldwide at WNZF.com. If you miss the broadcast, get the latest podcasts on the WNZF archives page.

Leave a Reply

Want to join the discussion?Feel free to contribute!