Declining inventory could dampen sales stats through the rest of the year.

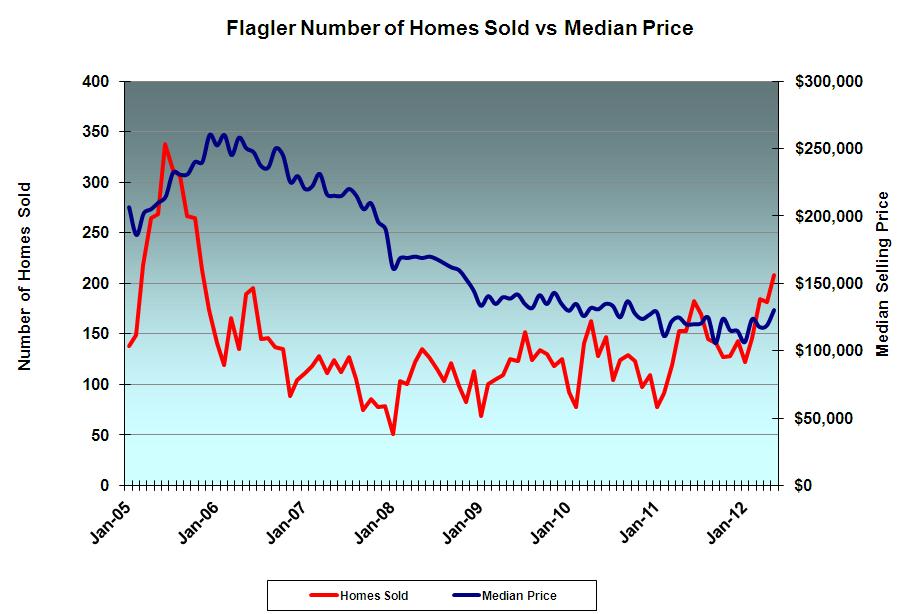

Palm Coast, FL – June 11, 2012 – There were 208 single-family Flagler County homes sold (closed) through MLS in May. By all measures, it was an outstanding month. The total represented the most homes sold in a single month since November 2005, when prices were reaching their peak. Median selling price was $130,500, highest since September 2010. The total value of the transactions was $34,748,615, a level not seen since October 2006.

Only 725 homes were listed for sale at the end of the month compared to 1,179 a year ago. A 725 home inventory represents only 3.5 month’s sales at May volumes. In another positive sign, there were 662 homes under contract compared to 524 at the same time last year. By June 11, inventory had grown to 740, but I think there is some risk that continuing low inventories levels may be a drag on sales volume in the second half of the year.

It’s a sellers’ market. So why aren’t prices rising?

Momentum for "bottom fisher" pricing will be hard to turn around. Several factors continue to hold prices in check. Banks are in the mood to move distressed inventory. They take guidance from similar sales where median price has wandered to lower levels for several years. And the distressed property market has few advocates for higher prices. Neither lenders nor short sale sellers are motivated to maximize selling price. They just want the transaction to be over. Real estate practitioners too are typically OK with going with the flow. A transaction closing at $120,000 now is preferable to a higher priced unsold listing with uncertain market potential.

Shrinking inventory has not affected pricing. Today’s sellers, even those who are not upside down, are made by necessity. They must sell. Why else would they be selling during the bottom of the market? As non-discretionary sellers, they lack the will to test the market by raising listing prices. Multiple-offer buyer bidding wars are more likely than sellers’ initiative to kick start price increases.

Tighter, though more realistic, lending standards and low appraisals continue to dampen buyer participation.

The percentage of May sales comprised of distressed property was 45.7%, less than in prior months where the percentage was stubbornly above 50%. The shift, perhaps temporary, probably accounts for the May increase in median selling price.

One month does not make a trend, but five do. Here’s how the first five months of 2012 stack up against the same months one year ago.

Flagler County/Palm Coast Home Sales – 2012 v. 2011

| |

|

2011

|

2012

|

Change

|

| May |

Homes Sold

|

153

|

208

|

+35.9%

|

| |

Median Selling Price

|

$120,000

|

$130,500

|

+8.8%

|

| |

Total Sales

|

$23,882,287

|

$34,748,615

|

+45.5%

|

| First Five Months |

Homes Sold

|

595

|

842

|

+41.5%

|

|

|

Median Selling Price

|

$120,000

|

$119,000

|

-0.8%

|

|

|

Total Sales

|

$97,763,359

|

$130,021,353

|

+32.1%

|

Building lot sales are booming. 72 lots were sold through MLS in May vs. only 28 a year ago. Lot sales are an indicator of future building plans. I’m having my building lot sales page redeveloped to handle the higher volume.

Builders too are showing more activity. Seagate Homes has five spec homes under construction in Flagler County. CBV Homes has begun a model home in the previously dormant Beach Haven community. Countywide, residential building permits are up 68% over the past three months compared to the same period in 2011.

Unfortunately, media headlines continue to fan the flames of Flagler’s foreclosure crisis. A recent article cited Flagler as having the worst foreclosure rate in the state in both February and April. Balderdash. Such reporting is not based on information readily available at the Clerk of Courts office which shows a much lower foreclosure rate. It also ignores the fact that current filings are not all new foreclosures. Many are re-filings of foreclosures that were previously withdrawn by lenders because of documentation problems.

Math Errors

The math is wrong in your column "Change". 120 -> 119 is not 8%. It might be 0.8%, I suspect. $97MM to $130MM is not 12%. It is more like 34% by my eye.

MLS Listings

Toby, if the Local MLS only has 750 properties listed why does Trulia list almost 4,500 for Palm Coast? Is the difference the Shadow Inventory owned by banks and investors?

Matanzas Golf Course

I have land off this course. Wish I could see the future when this course will open.

Reply to John Boy

My inventory number is for MLS-listed single-family homes in Flagler County only. I haven’t a clue where Trulia gets their numbers.