Flagler County – Palm Coast Housing Market Rocks – The Numbers Do Not Lie

Despite a months-long national pandemic and riots in several U.S. Cities, or perhaps because of them, Flagler County and Palm Coast are experiencing the most dynamic real estate market in 15 years.

PALM COAST, FL – August 9, 2020 – Despite a national pandemic and riots in several U.S. cities, or perhaps because of them, Flagler County and Palm Coast are experiencing the most dynamic real estate market in 15 years.

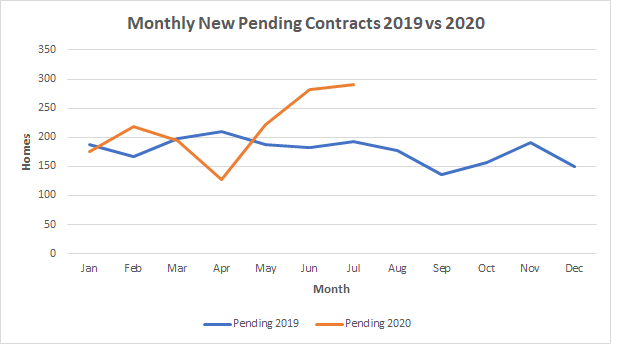

Employment is rising but the county’s June unemployment rate was still 9.7%. Restaurants and stores are open but with some remaining restrictions. Facing these strong headwinds, our real estate market is soaring. The Covid-19 shutdown put a damper on home buying activity only momentarily, evidenced by a dip in pending contracts in late March through early May. Since then, pending sales have surged beyond not only the year-ago rate but also the pre-pandemic rate. All this without the benefit of the Flagler Homebuilders Annual Spring Parade of Homes, now rescheduled for August 22nd through August 30th.

PENDING SALES CONTRACTS

The year-to-date median selling price through July for MLS-listed Flagler County single-family homes is $247,457, up 3.15% over the same period last year. 24.7% more homes were sold in the two months of June (276 homes) and July (295 homes) vs the same period last year. The median price for June was $260,000, for July $263,399, resulting in the first months to exceed the housing bubble peak of $259,990 set in December 2005. Respective June and July sales volumes for single-family homes sold also set all-time monthly records at $91.5M and $93.2M, respectively.

MONTHLY HOMES SOLD

.png)

New home construction roars forward uninterrupted. Through July, single-family permits are running 17.8% ahead of last year. Duplex permits are up by 35.4%.

This week, the inventory of MLS-listed single-family Flagler County homes for sale plunged below 600 to 579 homes, only six weeks before dropping below 700 homes for the first time since GoToby.com began tracking this metric. One year ago, over 900 homes were available.

To be sure, some of the reduced inventory of available homes is attributable to prospective buyers’ reluctance to having strangers walking through their homes. A larger reason for the decline in available inventory is the surge in pending sales. There are currently 550 homes under contract, a number approaching the total available inventory: currently at 579. The ratio of available inventory to pending sales (a measure I long ago dubbed the GINNdex in honor of developer Bobby Ginn) is 579:550, (approaching 1:1), an incredible metric.

The current pile of pending contracts plus the number of building permits ‘Issued’ and ‘Applied for’ assures a steady rate of sale closings well into the typically slow fall months. Industry professionals tell me that they are extremely busy with many citing increased buyer interests from those areas most affected by the pandemic and rioting (oops, I should say social unrest). Several recent news articles have noted the flight of northern urban residents to suburban, urban, and southern locations. Florida and Texas are often cited as the largest net beneficiaries of increased migration. Out-migration began two years ago with tax code revisions limiting deductions for state income tax and real estate taxes but has been accelerating due to recent events.

The underlying fundamentals of the market remain strong. There is an absence of short-term speculation and easy credit that marked the housing bubble. Buyers are end-users, either to occupy or to offer for rent.

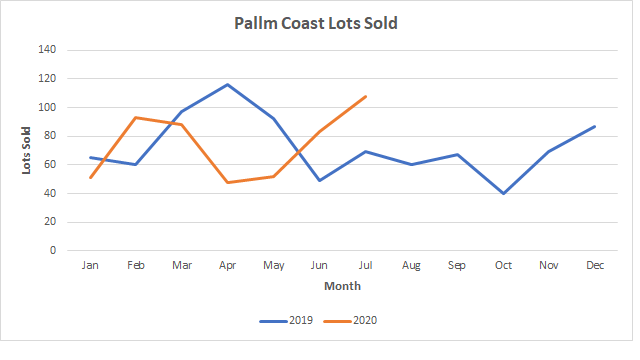

Locally, the original ITT-platted Palm Coast lots (excluding saltwater canal lots) are the closest thing to a commodity we can find. Because ready-to-build lots incur carrying costs but do not produce income, purchases are taken as an indicator of imminent plans to build. Year-to-date through July, PC lot sales are down 4.5% from 2019 with the median selling price rising from $21.8K to $23.3K.

As with homes, the sales pace and median price of PC lots are accelerating. In June and July, 191 lots sold for a median price of $25,000 compared to 118 lots at $22,000 during the same two months a year ago. At the peak of the housing bubble, PC lots sold for nearly $80,000 as speculators, including many builders, snapped up lots in a feeding frenzy.

PALM COAST LOTS SOLD

Current unemployment premium payments may be masking the strength of the underlying local economy. In a recent communication, Hammock Beach Resort members were told that all of the more than 200 employees laid off due to the Covid-19 shutdown had been recalled but only half had returned to work. Despite job fairs, the resort reported about 100 unfilled positions.

Great Article.

Thanks as always for your information. I know you just report it, but it is great to have positive news. We are seeing increases on our end as well. I’m glad to say that the increases are moderate as opposed to the runaway market back in the early/mid 2000’s.

You are an asset to Flagler County. Keep up the good work.