Flagler County, Fla. Population Surpasses 110,000

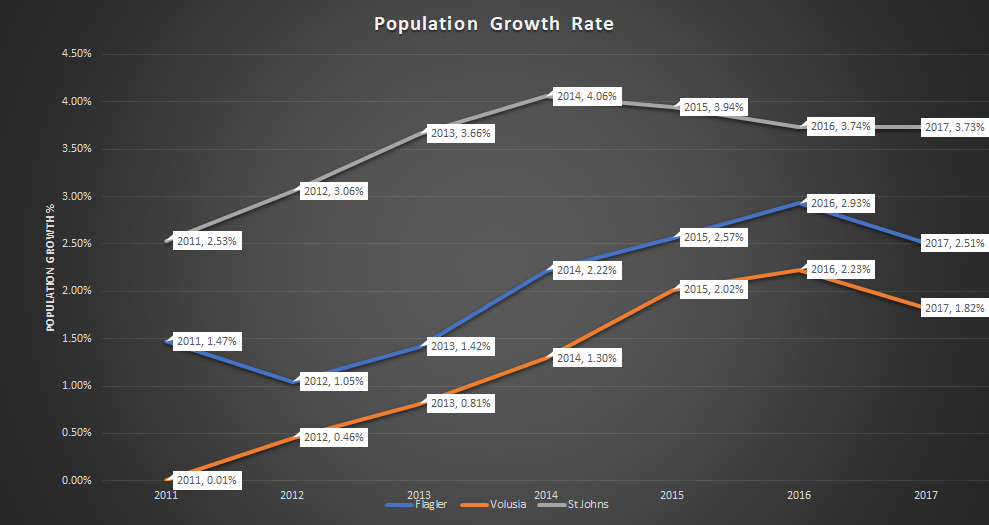

Flagler, Volusia, and St. Johns counties continue to grow. Growth rates dipped slightly for Flagler and Volusia. St. Johns growth is steady. All three surpass Florida’s growth rate.

PALM COAST, FL – March 22, 2018 – The U. S. Census Bureau today released its County and Metro/Micro Area Population Estimates showing estimated yearly population as of July 1, 2017. In other words, these newly released figures are population estimates as of eight months ago.

The Deltona – Daytona Beach – Ormond Beach Metro Area (which includes all of Flagler and Volusia counties) grew 1.94% from 636,843 to 649,202 during the period from July 1, 2016 to July 1, 2017. The Villages, last year’s fastest growing Metro Area at 4.3% dropped to 22nd place with a 2.5% growth.

Florida grew 1.59% during the same period, somewhat less than the 1.91% growth the previous year. Our state’s estimated population as of July '17 was 20,984,400. That level likely exceeds 21M by now.

Flagler, Volusia, and St. Johns counties each surpassed Florida’s 1.59% growth. Flagler’s population grew 2.51%, down slightly from the previous year’s 2.93%. Volusia also dropped; from 2.23% to 1.82%. St. Johns remained steady with 3.74% and 3.73% respectively.

Flagler County gained an estimated 2,705 residents, generating the need for approximately 1,200 to 1,300 new residential units (homes, condos, or apartments). During the July '16 to July '17 period, only 900 single-family building permits were issues. None were issued for condos or apartments. This imbalance has caused home prices and rents to rise faster than the CPI or wage growth.

Fortunately, builders have picked up the pace and plans for multi-family and other alternative housing are in the planning pipeline. However, I think local population growth is on the increase again. I would not be surprised to see the July '17 to July '18 population increase by more than 3,500 new residents.

Nationally

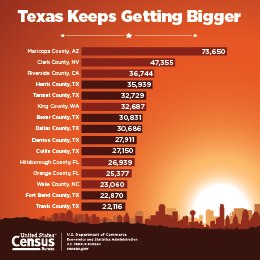

Texas took the limelight with eight of the 15 fastest growing counties. The Dallas-Fort Worth-Arlington metropolitan area’s 146,000-population increase last year was the most of any metro area and Maricopa County, Ariz., saw a population increase of nearly 74,000 — the most of any county last year — according to the U.S. Census Bureau’s July 1, 2017, population estimates released today. The statistics provide population estimates and components of change for the nation’s 382 metropolitan statistical areas, 551 micropolitan statistical areas and 3,142 counties.

Texas took the limelight with eight of the 15 fastest growing counties. The Dallas-Fort Worth-Arlington metropolitan area’s 146,000-population increase last year was the most of any metro area and Maricopa County, Ariz., saw a population increase of nearly 74,000 — the most of any county last year — according to the U.S. Census Bureau’s July 1, 2017, population estimates released today. The statistics provide population estimates and components of change for the nation’s 382 metropolitan statistical areas, 551 micropolitan statistical areas and 3,142 counties.

“Historically, the Dallas metro area attracts large numbers from both international and domestic migration. Many of the other largest metro areas in the country rely mostly on international migration and natural increase for growth,” said Molly Cromwell, a demographer at the Census Bureau.

Among the nation’s counties, the top 10 with the largest numeric growth are all located in the South and the West. The 10 largest counties in the country all maintained their rank compared to last year.

From July 1, 2016, to July 1, 2017, six of the top 10 largest-gaining counties were in Texas — Bexar, Collin, Dallas, Denton, Harris, and Tarrant. The remaining four counties on the list were Maricopa County, Ariz.; Clark County, Nev.; Riverside County, Calif.; and King County, Wash. Most of the nation’s 3,142 counties grew, with 57 percent gaining in the last year.

Counties

Gaining and losing population

- Between 2016 and 2017, 1,790 counties (57.0 percent) gained population and 1,342 counties (42.7 percent) lost population. This compared to 2015-2016, when 1,655 counties (52.7 percent) gained population and 1,480 counties (47.1 percent) lost population.

- Among counties with a population of 10,000 or more in 2016 and 2017, Falls Church City, Va. (a county equivalent), was the fastest-growing county with a 5.2 percent increase, adding 715 people. The rapid growth was mostly due to an increase in net domestic migration, with 492 more people moving in than out of the area between 2016 and 2017.

- The primary driver behind the growth of the 10 fastest-growing counties, 2016-2017, was net domestic migration.

Natural increase and decrease

- Between 2016 and 2017, 1,907 counties (60.7 percent) experienced natural increase, meaning there were more births than deaths. This compares to 2015-2016, when 1,942 counties (61.8 percent) experienced natural increase.

- Also between 2016 and 2017, 1,200 counties (38.2 percent) experienced natural decrease, meaning more people died in the county than were born. This compares to 2015-2016 when 1,164 counties (37.0 percent) experienced natural decrease.

Net migration

- Between 2016 and 2017, the number of counties that showed a positive net migration was 1,661 (52.9 percent), meaning more people moved into the county than moved out, and 1,470 (46.8 percent) counties showed negative net migration, meaning more people moved out of the county than moved into the county.

- Between 2015 and 2016, 1,469 counties (46.8 percent) showed positive net migration, and 1,660 counties (52.8 percent) showed negative net migration.

Metropolitan Areas

Growth

- Many of the top 10 metro areas with the largest numeric increases in 2015-2016 were also in the top 10 in 2016-2017, with the following notable exceptions: Washington-Arlington-Alexandria, DC-Va.-Md.-W.Va., climbed to 5th in 2017 from 11th in 2016, and Riverside-San Bernardino-Ontario, Calif., jumped to 7th in 2017 from 13th in 2016.

- In 2017, the Baltimore metro area was now the 20th most populous metro area, up from 21st place in 2016.

- Net domestic migration is the driving factor behind all of the top 10 fastest-growing metro areas that rose in rank — St. George, Utah; Coeur d’Alene, Idaho; Greely, Colo.; Lakeland, Fla.; and Boise, Idaho.

Decrease

- Out of 382 metro areas, 87 (22.8 percent) saw population decreases between 2016 and 2017.

- The metro areas that dropped in rank within the top 10 fastest-growing metro areas, between 2016 and 2017, did so because of decreases in net domestic migration. Those areas are Bend-Redmond, Ore.; Provo-Orem, Utah; The Villages, Fla.; Cape Coral-Fort Myers, Fla.; and Austin-Round Rock, Texas.

- The St. Louis, Mo.-Ill. metro area dropped out of the top 20 most populous metro areas and swapped places with Baltimore to its new 2017 standing of the 21st most populous area in the nation. In 1960, St Louis was the 9th largest metro area.

- A decrease in net domestic migration, meaning less of a gain from movement within the United States, was the primary factor in the Tampa metro area’s drop in rank from 7th in 2016 to 10th in 2017.

- The metro area with the largest percentage decrease in population last year was Casper, Wyo., down by 1.7 percent.

Toby Tobin: REALTOR®, SRES®

I am a REALTOR® licensed by the State of Florida and Seniors Real Estate Specialist, SRES®, with Grand Living Realty, where 'The GoToby Team' helps fellow aged 50+ buyers and sellers achieve improved outcomes in real estate transactions by integrating real estate decisions with other age-related decisions/plans through my broad network of respected service providers; financial, wills, trusts, probate, insurance, healthcare, home services, recreation, lifestyle, estate planning, and adult living facilities.

I am a REALTOR® licensed by the State of Florida and Seniors Real Estate Specialist, SRES®, with Grand Living Realty, where 'The GoToby Team' helps fellow aged 50+ buyers and sellers achieve improved outcomes in real estate transactions by integrating real estate decisions with other age-related decisions/plans through my broad network of respected service providers; financial, wills, trusts, probate, insurance, healthcare, home services, recreation, lifestyle, estate planning, and adult living facilities.

Take advantage of my "Been there. Done that." experience, typically at no additional cost to you. Call me at (386) 931-7124 or email me at Toby@GoToby.com.

Historic Perspective and Growth in Palm Coast

For the newer Palm Coasters – a historic perspective and growth in Palm Coast. My how cyclical History is – a great compare and contrast:

After Recession, Itt Expects Palm Coast To Blossom

August 19, 1991|By Gene Yasuda Of The Sentinel Staff

Ten years ago, when Ken Davidson Jr. moved to Palm Coast and tinkered with the idea of opening an automobile repair shop, he doubted that the rural community could supply him with customers.

”When I say there was nothing here, I mean there was nothing here,” said Davidson, who recalls driving 30 miles south to Daytona Beach just to buy groceries.

But seemingly overnight, 42,000 acres of rural plain on Florida’s East Coast has metamorphosed into a nucleus of a city. Palm Coast’s population has nearly doubled to 18,500 since 1986, helping Flagler County grow more quickly than any other county in the United States during the past decade.

”This place has just taken off,” said Davidson, who has watched his monthly sales hit $85,000 – a twelve-fold surge since 1985.

In reality, the creation of Palm Coast has been a 22-year endeavor, an uncommon project forged by the executives of a giant conglomerate – International Telephone and Telegraph – and state and county leaders.

Yet the recent recession has kept people and industry from moving to Palm Coast, spurring business leaders and analysts to speculate whether the project will ever fulfill ITT executives’ grand expectations.

”It’s growing, and it’s getting better. But from ITT’s perspective Palm Coast really has a way to go before it will ever be meaningful to them. . . . They may not want to wait that long,” said Jack Kelly, vice president at Goldman, Sachs & Co., a New York investment firm. Kelly specializes in following diversified companies such as ITT.

”The issue here isn’t whether it’ll be profitable. It’s how much they’ll make on it and whether it’ll become a major component of their business,” he said. ”I don’t think it will.”

ITT’s strategy of constructing a ”model” city has intrigued urban planners searching for a solution to overcrowding and gridlock. By laying roads, building parks and putting in water and sewer lines and other facilities to accommodate a population of 200,000 before the arrival of Palm Coast’s first residents, project planners expect to avoid urban nightmares.

In theory, by dominating virtually every development aspect of the community – nearly twice the size of Walt Disney World’s holdings in Central Florida – ITT should be able to rake in a king’s ransom.

But in reality, the difficulty of nurturing such a long-term project and the pressures of U.S. corporate strategy, which demand immediate gains, make ITT’s attempt to build a city a high-stakes gamble.

”There is a potential for significant return to ITT, but there’s no guarantee,” said Gary Walters, the planning director at ITT Community Development Corp., the wholly owned subsidiary that oversees Palm Coast development.

Twice as many workers

At first glance, the mix of industrial, retail and residential projects, tucked away among sculpted golf courses and parks, gives the impression that Palm Coast will fulfill its makers’ vision. Today nearly 8,000 people work in Flagler County.Two-thirds of Flagler’s population of 28,700 lives in Palm Coast. That employment figure has doubled since 1980.

Palm Coast’s main thoroughfare is now dotted with shopping centers, plus its very own Publix supermarket. A just-opened Cracker Barrel restaurant bustles with young families, belying the reputation of the development as a retirement community. In fact, school enrollment in Flagler County has soared to 4,023, up 48 percent from 2,725 in 1986.

Analysts speculate that ITT has poured $400 million into Palm Coast during the past 12 years – perhaps as much as $1 billion during the project’s life span – to transform Palm Coast into a fledgling community. Yet the project is years, if not decades, away from showing a return on the New York-based conglomerate’s investments.

And during the years, the company has endured costly bureaucratic hassles negotiating with – and, at times, combatting – state regulatory agencies and environmental groups.

During the late 1980s, a period ITT officials describe as the time ”Palm Coast really began to take off,” ITT-CDC posted healthy profits as it lured businesses, from boat manufacturers to electronic companies, to its industrial parks.

”But we’re nowhere near recouping our investment,” said Jim Gardner, president of ITT-CDC.

Although most of their obstacles seem behind them, ITT officials say they can hardly afford to sit back and expect money to roll in.

The company’s strategy works like this: Sell Palm Coast property to industry. Sell residential lots to the new businesses’ employees and then build homes for them. Hold conferences at the Sheraton Hotel, a part of ITT’s hospitality subsidiary. Sell memberships to use golf courses and tennis courts operated by SunSport Recreation Inc. – an ITT-CDC subsidiary that manages recreational facilities at Palm Coast.

But creating a community from scratch is complicated, and being its omnipresent builder attracts problems, said Walters, the project’s planning director.

Too many frogs

Palm Coast is still an unincorporated area of Flagler County and lacks a municipal government. As a result, residents often turn to ITT-CDC to solve the growing community’s problems.

The developer has donated land to the county for schools and parks and has absorbed the cost of maintaining Palm Coast’s landscape. And whether it’s at fault or not, the company is often the target of residents’ gripes

”I had a lady call and complain that there were too many frogs in her pond, and she wanted ITT to do something about it,” said Dorothy Zierk, a secretary for ITT’s vice president of community relations.

Furthermore, economic downturns such as the recent recession are extending the time ITT executives must wait before they can recoup their investment.

”The Northeast, as you know, has been hit terribly by the recession, and that’s a real concern for us,” said Gardner, ITT-CDC’s president. The bulk of the developer’s industrial and residential recruiting is directed toward the Northeast.

”Companies don’t want to make any moves during uncertain economic times,” Gardner said.

Point of no return

During 1990 and through the first seven months of this year, ITT-CDC has been unable to recruit a major employer to Palm Coast.

Between 1986 and 1988, ITT-CDC sales of industrial land increased 37 percent, from 636,000 square feet to 872,000 square feet. But since 1988, sale of such space has increased 9 percent.

Flagler County residential construction sales also have fallen, from $70.9 million in 1989 to $56.4 million in 1990.

”As far as the resident goes,” Gardner added, ”they can’t move down here because they can’t sell their homes up there.”

Nevertheless, ITT executives say Palm Coast’s climate, abundant infrastructure and immediate access to the Intracoastal Waterway, the Florida East Coast Railway and the Flagler County Airport will attract businesses and residents as soon as the economy begins its recovery.

And ITT executives say that even if the recovery is slow in coming they have invested too much in Palm Coast to walk away.

”We’ve gone beyond the point of no return,” Walters said.

But ITT-CDC’s steadfastness is more attributable to executives’ belief that Palm Coast will make money – if not today, then tomorrow.

ITT does not disclose its subsidiaries’ earnings, but records from Flagler County’s assessor’s office illustrate that the value of Palm Coast property has increased under ITT-CDC’s management.

In 1981 the assessed value of Palm Coast property sold until then by ITT was $278 million. Today total ITT property sold is worth $1.1 billion. And the conglomerate still owns undeveloped property valued at $305.2 million.

Affordable homes wanted

Flagler County officials and business leaders remain confident in Palm Coast’s economic viability but say the affluent development lacks a major element needed to attract industry: affordable housing.

”If we’re going to get companies to relocate here, we need to provide housing for their employees,” said Al Jones, Flagler County commissioner. ”So far, we haven’t been able to accommodate that need.”

The county and the business community are discussing ways to build homes priced near $50,000.

ITT officials say Palm Coast offers a variety of housing projects, ranging in price from $60,000 homes to $800,000 beachfront properties, with an average home selling for $100,000.

Local business leaders say, however, that they are confident that ITT will make its development project successful.

”All the major arteries have already been put in place (by ITT-CDC). So you don’t have to worry about traffic problems,” said Jeff Skuda, general manager of Sea Ray Boats Inc., a major boat manufacturer and one of Palm Coast’s first industrial tenants.

”They’ve plodded along and have put together an impressive project,” Skuda said. ”In my opinion ITT could pull out of Palm Coast now, and it’ll still keep growing on its own.”

James Gardner Sr. was the third Father of Palm Coast being employed by I.T.T. Community Development Corporation from 1978 until his retirement in 2000.

Regarding driving to Daytona / Ormond for milk , bread, cheese – I / my family enjoyed this because it was a small price to pay . Why, because we knew we were returning to Levitt & I.T.T. Palm Coast a true Paradise, made given by Dr. J. Norman Young, first Father of Palm Coast, then Alan Smolen, Second Father of Palm Coast and most especially James Gardner – third Father of Palm Coast. Their combined efforts for decades gave us Paradise. For instance, free sprinkler and hoses because for a while the Water was FREE, Free eats typically weekly, FREE Golf , for me/us for Ten Years of Free Golf , great oceanside Beach Club, Great Sheratons, etc.

I still have my Membership Card for the Palm Coast Golf Club, later known as our cherished and beloved Amenity – the Palm Harbor Golf Club. Presently, documents have started to flow to the State of Florida Historic Preservation Offices for Historic Status for our Golf Club. It has been assigned the number FL 000931. FL stands for ‘ Flagler County’ and the number assigned 009331 is the numerical sequence assigned by the State of Florida Historic Preservation Offices. Also, they assigned THREE Specialist to help with the Historic Status. For me, it is very joyful because I saw the front nine and then the back nine being built…and hopefully soon…I will see it achieve Historic Status , hopefully Grants coming, Hopefully also mention within the State of Florida Historic Golf Trails.

What a joyous day that will be for me.

I hope this information help give Palm Coasters a sense of Identity and a sense of place for you.

Thank you very much for listening.

Thank You.