Flagler County and Palm Coast’s Second Real Estate Boom

This incredible real estate market shows no signs of slowing down. The only factor that might slow sales is the lack of inventory. You cannot buy what is not for sale.

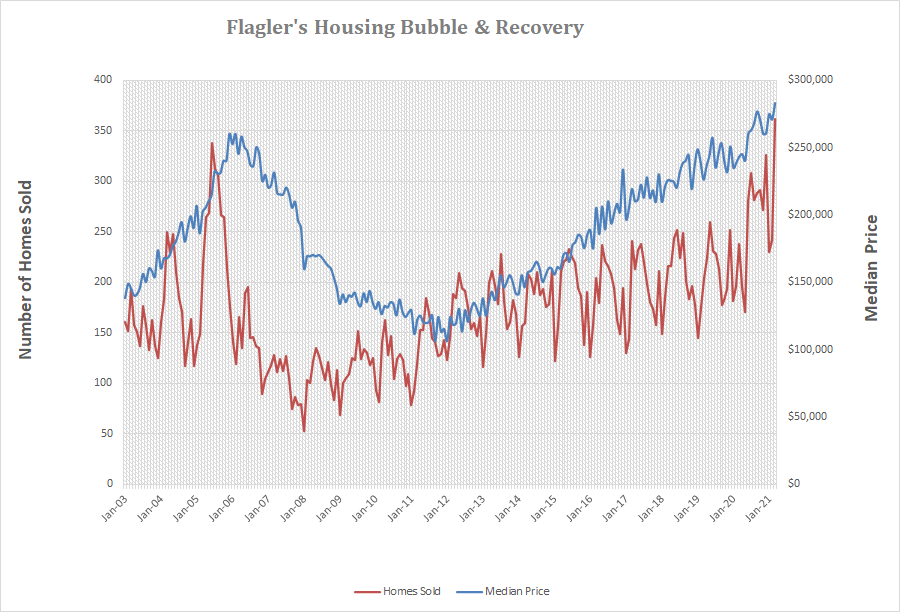

PALM COAST, FL – April 19, 2021 – The Flagler County/Palm Coast housing market burst out of the mini Covid-19 slump in June when the median selling price of single-family Flagler County homes sold through MLS for the first time broke the high-level mark of $259,950 reached at the peak of the housing bubble 16 years ago. It has remained above that level every month since and continues to climb.

March Results

Homes

- 362 single-family Flagler County homes were sold through MLS in March. This exceeds the previous peak number of home sales reached in 2005 during the housing bubble. It also represents a 52.1% increase over home sales in March one year ago.

- The median selling price for homes sold in March was $282,743, representing a 16.36 increase year over year.

- The total value of homes sold in March was $133,398,386, a whopping increase of 100.1% from March a year ago.

- Median Days on Market (DOM) dropped from 41 to 20.

Condominiums

- 62 condominiums were sold, up from 39.

- The medium selling price for condos was $277,000, up 15.4% from $240,000.

- DOM was 31 vs 55 last year.

Building Lots

- Building lots are not generally considered a good long-term investment, especially when they are in private communities. Lots have carrying costs and they generate no income. Hence, lots purchased represent a good indicator of near-term plans to begin new construction.

- 286 building lots sold in Flagler County in March, representing a 146.5% increase over the 143 lots sold one year earlier.

- Even more significant is the upward movement of lot selling prices. The median selling price rose 117.4% in March, year over year from $22,750 to $49,450.

- DOM dropped from 143 to 22 days.

Building Permits

- 234 single-family building permits were issued, up from 123 last March.

- 36 duplex building permits (72 living units), up from 15/30 last March.

Year-to-Date

Year-to-date statistics are more predictive than monthly metrics, but in today’s market, they are no less impressive.

Homes

- For the first quarter of 2021, home sales increased 35.9% over the first quarter of 2020.

- The median selling price rose to $276,950, up 15.4% from $240,000. That is a $36,950 increase over one year. Property owners are feeling fairly good about their rise in equity.

- Total sales volume was $291.6M, up 67.2%. Realtors and others whose income are based on real estate transaction volume are likewise delighted.

- DOM dropped 61.4% from 44 to 17 days. Buyers are frustrated.

Condominiums

- 141 condos sold vs 104, up 35.6%.

- The median price for condos rose from $224,368 to $279,000, a 24.3% increase.

- DOM dropped from 55 to 36 days.

Building Lots

- 642 lots sold in the first quarter, up 104.5% from 314.

- The median lot selling price rose from $23,000 to $45,000, a 95.7% rise.

- DOM dropped from 119 to 33 days.

Building Permits

- Single-family home new construction permits issued in the first quarter were 598 vs 344 in the first quarter of 2020, a 73.8% increase.

- There were 54 duplex permits issued (108 living units) vs 44 (88 units) last year.

Notable Facts

- Typically, the number of homes listed for sale exceeds the number of homes under contract (Pending) by a factor of two or more. Today, for each home listed for sale, there are 3.3 homes under contract (and 6.5 realtors).

- Of the 676 homes under contract, more than half were on the market for less than two weeks.

- Only 0.4% of our existing housing stock is available for sale.

- When “Under Construction” homes are excluded, the number of listed existing homes is only 159 countywide with 385 existing homes under contract. Half went under contract within seven days.

Outlook

Flagler County has been rediscovered. Its population is exploding again. The accelerated growth is long-term. There are numerous drivers of migration.

Taxes

Since the Trump tax cuts capped deductions for state and local real estate taxes and mortgage interest, there has been an increase in migration from high-tax states, primarily in the Northeast and northern Midwest to low-tax states, primarily in the west and south.

Covid-19

Individual health is a visceral concern. Residents of those states suffering from greater Covid hospitalization and death rates have decided to relocate to states, cities, and counties that have lower hospitalization and death rates, more sunshine, warmer temperatures, and abundant outdoor activity options. Despite Flagler’s high (31.2%) percentage of aged 65+ residents (double the national average and well above Florida’s 20.9%), the county ranks among the lowest in the state for Covid infection rates, hospitalizations, and deaths.

Safety

Despite media reports of peaceful protesting, most people know a riot when they see one. They also notice the extensive destruction of property, personal injury, and loss of life. As the desire for individual health, the desire for individual safety is visceral. Not only does Flagler County offer great climate, lifestyle, and affordability (compared to the high-tax states), it is a safe place to live. The crime rate is low and continues to decrease.

Remote Workers

Some employees and executives relegated to working at home will return to the traditional office environment post-Covid, but most analysts believe that many will continue to work remotely, at least part-time. Flagler County offers an irresistible lifestyle/work/affordability opportunity, proven by Coastal Cloud’s slogan, “Live at the beach. Work in the cloud.” No problem recruiting there!

MedNex and University of Jacksonville

Two major universities plan new healthcare curriculum-focused satellite campuses in Town Center. Our area is poised to become a healthcare mecca, educating our young people for well-paying jobs that will be created here. Healthcare pays well and is a growing industry. Growing industries recruit primarily from younger members of the population. They also spawn entrepreneurship which will drive further economic development.

Lack of Inventory

The inventory of available housing is critically low. There are clearly some potential sellers who remain reluctant to open their homes to potential buyers but their return to normal will be gradual.

New home builders are severely constrained by a lack of qualified construction workers, shortages of building materials, and rising costs for materials, labor, and land. Builders are finding it increasingly difficult to find shovel-ready land or buildable lots.

There is no quick fix for the shortage. So long as demand overwhelms supply, prices are likely to rise, encouraging potential sellers to wait even longer to enter the market.

Analysis

Each of these factors has a lot of momentum. Our housing market is extraordinarily strong, but unlike the housing bubble, of which Flagler County was a poster child. Today’s demand is driven not by speculation but by end-uses. Interest rates are low but easy credit is gone. Any existing inventory of vacant distressed property has long since been absorbed, leaving new construction as the only solution to population growth.

Double-digit price appreciation is not sustainable, but not all the current increases in median selling price can be attributed to rising property values. Unlike average, median means half below and half above. Even without property values rising, it is possible to have a rise in median price by simply changing the mix of properties sold, shifting more activity at the high end of the market.

Illustrating this possibility, the first quarter of 2020 saw only four home transactions at or above $1M, with only one of them above $2M. The first quarter of 2021 saw 16 $1M plus sales with three of them over $2M. Through only 19 days in April, there have been eight home sales above $1M. In the grand migration, it stands to reason that those with the greatest financial resources have the flexibility to relocate soonest.

Residents will be beneficiaries of our revitalized real estate market. Future residential property tax increases will be moderated by commercial development which will carry a greater share of the tax burden. We might even have more dining options on the Intracoastal Waterway, a Trader Joe’s, or a Costco. Not to mention, great healthcare and a well-rounded and more resilient economy.

It’s all good – unless you are someone who doesn’t want anything in your backyard.

Leave a Reply

Want to join the discussion?Feel free to contribute!