Distressed Home and Condo Sales Evaporating – Which Areas Were Hit Hardest?

Only 17 of 765 MLS-listed Flagler County homes are distressed listings. Of 280 listed Flagler County condominiums, only 5 are distressed.

PALM COAST, FL – June 5, 2016 – Flagler County’s glut of distressed residential properties is all but gone, ending eight years of distorted comps and unsightly neighborhoods. All segments of the local market were affected, but some suffered more than others.

Locally, home prices peaked during the winter of 2005-2006. Those who bought during those years likely paid a higher premium (above intrinsic value) than those who bought earlier or later. Likewise, homeowners who refinanced during that period found themselves underwater as soon as home values slipped.

Much of the rapid growth was fed by speculation and zero-down loans. When the market crashed, speculators were left with underwater investments and no exit strategy. Owner/residents were underwater, unable to sell because they did not have financial reserves to cover the gap between the likely selling priceof their home and the balance of their mortgage(s). Still others were tripped up by variable loan rate adjustments.

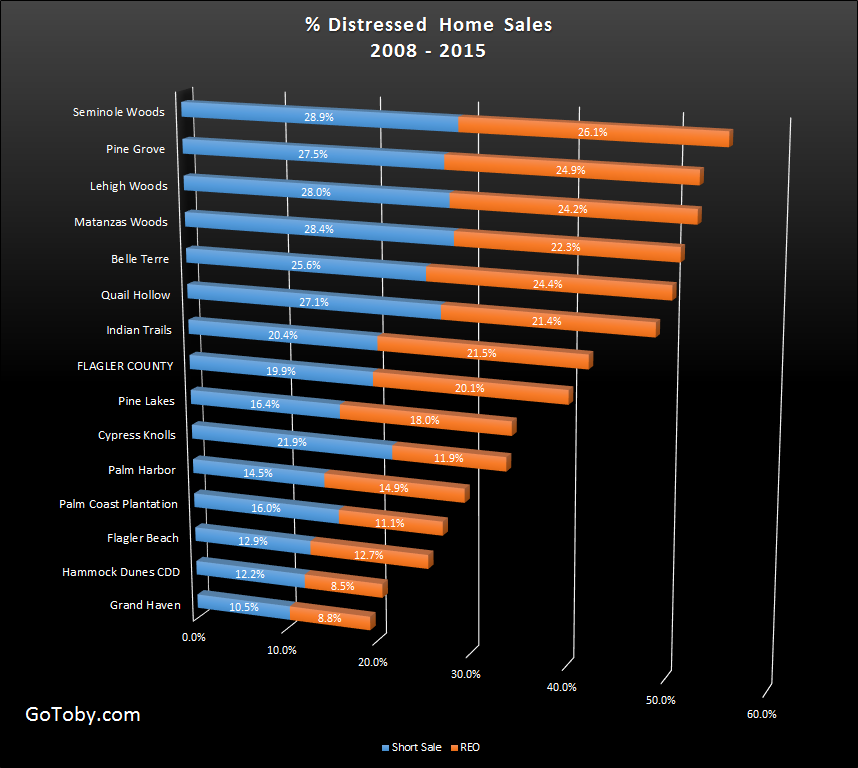

GoToby.com looks back on home and condo sales over the past eight years, measuring the percentage of MLS-reported transactions that were attributed to either short sales or REO (bank-owned foreclosed). Seminole Woods, Pine Grove, Lehigh Woods, Matanzas Woods, Belle Terre, Quail Hollow and Indian Trails all had distress home sales percentages above the overall Flagler County rate.

Eight Years of Distressed Home Sales

More established sections of the county and upscale communities where homeowners presumably have greater financial reserves, fared better. Pine Lakes, Cypress Knolls, Palm Harbor, Palm Coast Plantation, Flagler Beach, Hammock Dunes CDD (Hammock Dunes, Island Estates, Ocean Hammock, Hammock Beach and Harbor Village Marina) and Grand Haven fared better than the county average.

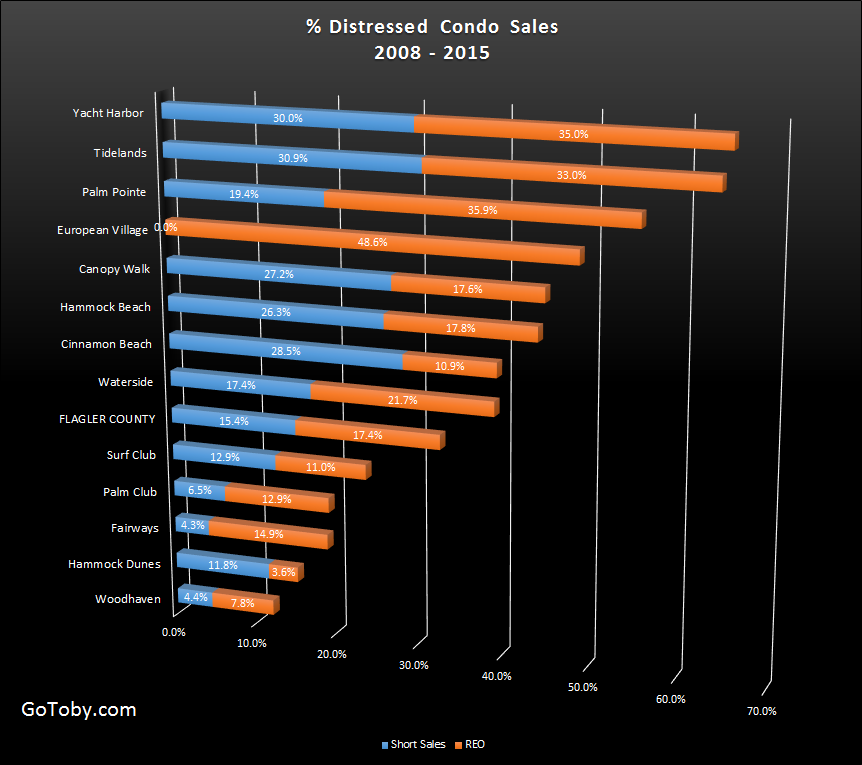

Eight Years of Distressed Condo Sales

The condominium communities with the highest distressed property sales rates were Yacht Harbor Village, Tidelands, Palm Pointe and European Village; all built in 2005 or 2006. During the eight-years from 2008 to 2015, both Yacht Harbor Village and Tidelands had cumulative distressed sales percentages above 60%. Today, neither community has even a single distressed listing.

Distressed home sales reached their highest percentage rate during 2009, 2010 and 2011, exceeding 50% in each of the three years. Distressed condo sales peaked in 2011, the only year in which the rate exceeded 50%.

Tidelands condo fees

Knowing that the REO’s are about gone, are there any plans by the condo association at Tidelands to lower their fees, or go back to including the water bill like they used to?

Reply to Gail

Tidelands has, in fact, reduced the Condominium Association fees; twice. The first time was to offset the move from ‘water and sewer included’ to ‘owner pays water and sewer.’ The decision to make the change was not done by the Board or the property manager. It was supported by a super-majority of the property owners. The rational was that those, like myself, who lived here permanently, used water all year while other owners visited only for weeks or months at a time. They were, in effect, subsidizing my full-year water usage. I, and most full time residents, voted in favor of the change. Fees were reduced to adjust for the ‘average’ water usage.

The second reduction was more recent. The Club Dues portion was reduced. Prior to the recent ‘turnover’ of the amenities from the Developer to the Association, the Developer controlled the Club amenities, and therefore, the dues. Now, these expenses are controlled by the Board. Costs have been reduced by, I think, $20/month.