Today�s extremely low levels of new residential production could lead to significant housing shortages as household formation rates return to normal.

Palm Coast, FL – March 1, 2010 – Nation’s Building News, the official on-line weekly newspaper of the National Home Builders Association (NHBA) indicates that a housing shortage may be arriving soon. The reason; new home construction is way down.

Source: Nation’s Building News (a publication of NHBA)

Even as foreclosures continue to flood some of the worst-hit housing markets in the country, economists are beginning to sound the warning that today’s extremely low levels of new residential production could lead to significant housing shortages, especially among market-rate rental apartments, as household formation rates return to normal.

Even as foreclosures continue to flood some of the worst-hit housing markets in the country, economists are beginning to sound the warning that today’s extremely low levels of new residential production could lead to significant housing shortages, especially among market-rate rental apartments, as household formation rates return to normal.The housing downturn and economic recession have kept household formation rates at below-normal levels for roughly three years, said NAHB Chief Economist David Crowe. As the economy moves to higher ground, the housing market will begin to feel the pressure from new households, he said, and there will be a surge of demand from echo boomers, who comprise an even larger group than their baby-boomer parents.

NAHB economists project that the industry will need to deliver 16 million homes over the next 10 years to keep pace with demand. As the excess inventory is worked off, which is likely by the end of 2012, the long-run demand for new housing — based on population growth, immigration and the replacement of losses from the housing stock — will average approximately 1.5 million single-family and 300,000 multifamily units annually, or about 1.8 to 1.9 million total starts.

Coming off extremely low levels of construction, starts last month were running at a seasonally adjusted annual rate of 591,000, a level that is far below what will be needed.

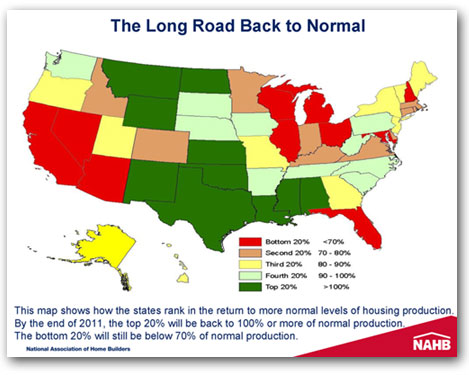

When housing starts bottomed out in the first quarter of 2009, they were running at only 27% of average starts during the “normal” production period of 2000 to 2003, according to analysis by NAHB. This year, production is expected to rise to 45% of normal, with a further increase to 67% of normal next year.

The road back to normal levels of residential construction will be longer for some states than others. By the end of 2011, the top 20% of the states will see their production levels back to normal. Those states include Montana, Wyoming, North Dakota, New Mexico, Kansas, Oklahoma, Texas, Louisiana, Mississippi and Alabama.

NAHB is forecasting 647,000 total housing starts in 2010 and 991,000 in 2011, an indication of expectations for housing to recover at a relatively slow pace. Curtailed credit to build new housing is a major constraint, and the availability of acquisition, development and construction (AD&C) financing is expected to remain exceptionally tight even during the early phases of the housing upturn.

Severe Apartment Shortages

Multifamily developers at last month’s International Builders’ Show said that their segment of the housing industry is suffering disproportionately because of the credit crisis. New multifamily construction has been reduced to a snail’s pace, they said.

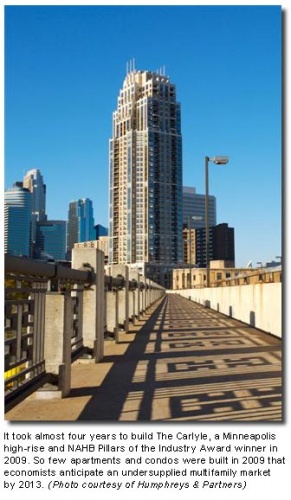

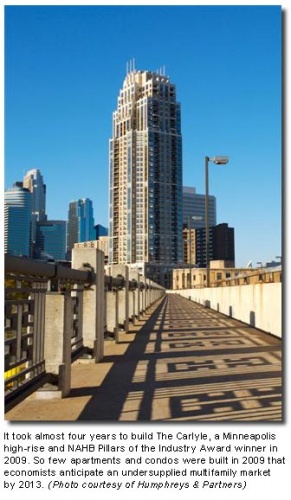

With multifamily buildings typically requiring two to three years to be completed, leaders in the industry predict that there will be a severe shortage of apartments over the next few years.

“We desperately need lenders to begin financing apartment communities again,” said Crowe. “The vacancy rate for apartments is elevated now, but as the economy recovers and jobs return, the people who have been doubling up with relatives and friends will want a place of their own — and there may not be one available.”

Builders are expected to break ground on only 87,000 multifamily units this year, according to NAHB projections, compared to an average of about 300,000 in recent years.

NAHB Senior Economist Bernard Markstein said that the multifamily starts rate was unlikely to break 100,000 units on a sustained basis until the end of this year. Multifamily will be lagging behind other sectors, he said, in a slow and protracted recovery that will bring total production to 150,000 units in 2011.

Further declines in the nation’s homeownership rate and a corresponding rise in the renter share of total households will only exacerbate the impact of today’s anemic pace of multifamily rental property construction.

A large number of Generation Y professionals and newly formed households — for whom multifamily is often the most attractive option — are expected to enter the housing market soon. They are likely to find fewer market-rate and affordable rental units to choose from, and higher rents due to increased demand.

Convention-goers heard some sobering first-hand accounts of the current climate for multifamily development from three members of NAHB’s Multifamily Leadership Board:

-

Jerry Durkin, chairman and CEO of Wood Partners in Atlanta, said that his company started one 150-unit project last year, down from an annual average of about 3,600 units over the past 10 years. This year he said three projects — a distressed condo rehab in California and small buildings in Boston and Atlanta — should increase his firm’s starts to 500 units, down from the 6,500-unit range in 2006-2007.

Most sources of money are “on the sidelines,” he said, and most deals need to be small. “Capital has to free up in 2010 for things to get going in 2011,” he said, “so next year is likely to be slow.”

-

Mark Tennison, CEO of Equity Residential, a multifamily REIT based in Chicago, said starts would be limited this year but opportunities should be increasing in 2011 and 2012 in larger urban markets such as New York City, Los Angeles, Boston, Washington, D.C. and Seattle.

Tennison is also looking to improve Equity’s portfolio in the larger coastal markets by acquiring “high-spec, high-quality properties that were built as condos.”

-

Michael Costa, president and CEO of MacFarlane Costa Housing Partners in Gardena, Calif., a builder of affordable/tax credit housing communities nationwide, said he is working today on four projects. That’s compared to 90 projects in one stage or another at any given time in recent years and an annual starts rate of 30 to 35 projects averaging 100 to 150 units in the $15 to $30 million range.

“The focus is now back to our portfolios,” he said. “We are looking for ways to operate these as efficiently as possible.” Costa said he is looking for new development opportunities, but gap financing is needed because of lower loan-to-value ratios and “a lot less permanent financing available.”

Costa said he has pulled his company back from a national scope to concentrate on his home territory of California. He is looking to build a better portfolio by acquiring Low Income Housing Tax Credit properties whose subsidized status is coming to an end. “When the renters return, there will be much more demand than supply,” he said.

The panelists said they expect demand to outstrip the current supply of rental apartments by the middle of next year, with growing shortages through 2014. This is very likely, they said, to increase average market-rate rents by as much as 8% to 10% in both 2011 and 2012 and by 4% to 7% in 2013 through 2015.

The segment of the industry that benefits from these rising rents will be those who own rental apartments, Durkin said.

Source: Nation’s Building News (a publication of NHBA)

Even as foreclosures continue to flood some of the worst-hit housing markets in the country, economists are beginning to sound the warning that today’s extremely low levels of new residential production could lead to significant housing shortages, especially among market-rate rental apartments, as household formation rates return to normal.

Even as foreclosures continue to flood some of the worst-hit housing markets in the country, economists are beginning to sound the warning that today’s extremely low levels of new residential production could lead to significant housing shortages, especially among market-rate rental apartments, as household formation rates return to normal.

Housing Shortage

This should be good news to builders. I know Adams, Seagate and Moronda have inventory homes available for sale. Not sure they will be willing to start more production until they see more sales. The market will make the decision, not predictions.