Palm Coast Golf Courses Lose 80.74 Percent of Appraised Value in Five years

The debate over the failed sale of the closed Matanzas Golf Course prompts another look at local course values.

Palm Coast, FL – January 7, 2014 – A December 30th GoToby.com article, Jim Cullis Pulls Out of Matanzas Golf Course Sale, elicited several strong reader comments. They prompted me to do a follow up on an article from two years ago about the declining values of Palm Coast’s golf courses. The local picture is not unique.

The 2008 tax year saw the peak for Flagler County with a total taxable property value of $11.1 billion. Five years later, the county’s 2013 taxable value had dropped 44.3%to $6.2 billion. The most recent year actually showed a 0.8% increase.

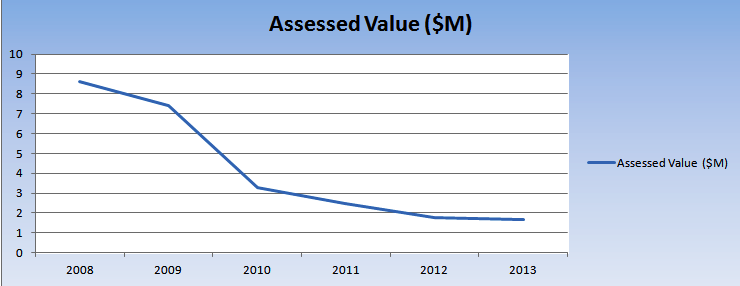

Flagler County golf courses did not fare so well over the same period, continuing to decline through the 2013 tax year.

| Course | 2008 | 2013 | % Change |

| Grand Haven | 6.65 | 1.50 | -77.4% |

| Pine Lakes | 4.58 | 1.02 | -77.7% |

| Cypress | 3.76 | 0.88 | -76.6% |

| Matanzzas | 2.35 | 0.20 | -91.5% |

| Grand Reserve | 3.68 | 0.31 | -91.6% |

| Palm Harbor (Muni) | 2.17 | 0.68 | -68.7% |

| Hammock Dunes Links | 17.34 | 2.73 | -84.4% |

| Hammock Dunes Creek | 5.35 | 1.14 | -78.7% |

| Hammock Beach Ocean | 31.72 | 4.23 | -86.7% |

| Hammock Beach Conservatory | 8.49 | 3.91 | -53.9% |

| Totals | 84.94 | 16.59 | -80.74% |

Note:

Assessed values include clubhouses. Grand Haven has a 9,517 SF clubhouse. Cypress has 5,736 SF, Pine Lakes has 18,368 SF, Hammock Dunes Links has 35,566 SF, Hammock Dunes Creek has 4,383 SF, Hammock Beach Ocean has 38,562 SF (includes lodge rooms), Hammock Beach Conservatory has 38,834 SF

Assessed Value of all Flagler County Golf Courses

Relevant facts:

- The City of Palm Coast paid nothing for the Palm Harbor Golf Course which was assessed for $2.1 million. The city then spent roughly $5 million to rehabilitate the course. The city will lose about $100 thousand operating the course in 2013.

- The Grand Haven Golf Club which carries the Jack Nicklaus Signature designation, sold for $1.5 million (plus other considerations) in December 2011. Grand Haven was assessed for $6.6 million in 2008.

- The current value of the area courses reflects the lack of potential buyers. If industry experts envisioned a market turnaround soon, they would be snapping up today’s bargains. And as long as course prices remain well below replacement cost, there is little likelihood of resurgence in the construction of new courses.

- The Grand Club, including Cypress, Pine Lakes and the closed Matanzas courses was purchased for $2 million from bankrupt Landmar in 2011. Landmar paid $10.75 million for the three courses in 2004 when Matanzas was open and thriving.

- The Grand Reserve has not paid property taxes for 2013 or for the two previous years totaling $42,739. The course was taken back by the lender in 2011.

- Hammock Beach’s Ocean Course currently carries a $4.2 million appraisal. Lowes sold the Ocean Course to Centex in December 2005 for $35 million. Centex resold the course one year later to the Ginn Company for $37.7 million. Today, the total assessed value of all ten courses in the county is less than half what Ginn paid for the Ocean Course seven years ago.

- Baby boomers were a key component in the theory of an ever-rising market. The Great Recession upset that theory. The first wave of boomers to arrive after the market tumbled found that they could enjoy golf a la carte, paying discounted rates for quality courses forced to accept day play to pick up incremental revenue. That wave of boomers and perhaps many to follow have been forever lost as potential club members.

This analysis is meant to shine light on the economic realities of the U.S. golf industry and its effect on local constituents. It will probably do little to change the mindset of those on either side of the Matanzas debate.

Cost of Maintenance

Do we know how high the annual cost are to maintain an average golf course ??? Do we have any idea how many members each golf club has ???

Thanks for your reporting Toby.

Golf Courses

1. We can really thank the city officials for most of this decline, since it is obvious that they lack concern for the growth of this city. Just look around at neighboring communities and cities that are growing, slowly bit growing.

2. The Palm Harbor Golf Course did initially cost the city as they took the course in trade for fees that allegedly were never paid by the previous owner and then the city sunk more money into the venture which is a losing proposition and is paid or subsidized by, who else the residents and taxpayers of this Great City.

Golf Course assessments

Something is wrong with this picture, golf course are income prooducing verses residential property. Even if income is down some what, why would assessments drop by these amounts. My assessment and taes have gone up every year since 2008 and all I seen is a significant reduction in the value of my home if I was to sell. I think thwere needs to be a criminal investigation, there may well be a conspiricy on how assessments and resulting real estate taxes are being handled on income producing golf courses. I call on the Local State Attorney to look into this, clearly someone needs to go to jail. Follow the money, is some government offical getting rich at th expense of the Flagler County taxpayers?

Response to Flatsflyer

Assessments are based simply on the prices for which comparable properties have recently sold. Golf courses are revenue producing, but for several years, they have not been income producing. In other words, how much will someone pay to buy the place, not how much revenue they produced?

Golf courses have a high fixed maintenance cost, regardless of how many rounds of play. The fixed costs have remained while revenue is down due to fewer rounds played, fewer new member deposits, fewer membership dues and lower revenue per round played. That’s why nobody wants to buy golf courses today. Thus, low selling prices and low assessments.

The assessment process is defined by Florida Statute. The 2013 assessments are based on comparable sales that occurred in 2012. 2014 assessments will be based on comparable sales in 2013 and so on.

Good Perspective

It’s become obvious to me that people 1) forget golf is a business, and 2) think if there is not more of something that it will “go away”. Both are misleading and cause to people not come to logical conclusions.

Golf is a business and industry professionals admit that they got it wrong in the later part of the 1990’s and early 2000’s. They over estimated demand which drove 100+ golf courses being open throughout the country each year for a while. They saturated the market and hurt themselves.

Even if our County grows to the 200,000+ residents projected over the next 6-10 years, it’s doubtful there will be demand for anymore courses than the ones existing now. That’s not a “bad thing”. Rather it’s a good thing, because those businesses should thrive and be able expand services to their customers (i.e. improved clubhouses, etc.). What the area doesn’t need is more courses that simply spreads the business out more (because more locations doesn’t mean demand grows) hurting all of the courses putting those left in real danger of being able to survive. Pine Lakes or Cypress Knoll suffering the fate of Matanzas Woods would NOT be a good thing for Palm Coast.

Rework numbers.

I’d like to see the numbers reworked without any properties that are no longer golf courses. Also, a comparison with other non golf sports properties would be helpful. I think we’ll find that all nonessential pastimes have lost value due to the economy. I mean, heck, just talk to the owner of the boatyard where I store my boat. Wayne will set you straight about the decline in the boat business over the past several years. What really puzzles me and deeply concerns me is what seems to be a deep seated alienation toward golf by some folks in this area. Where we came from in central Ohio, they not only have Muirfield and New Albany CC among others but many, many public courses all turning profits. Per capita, compared to other areas, we’re under served for golf. You can build all the houses you like but if you don’t have a draw for people to come here, people with disposable income, who like to say golf and boat, those houses will not sell. The whole deal of wanting to bulldoze golf courses is self defeating, it will in the end degrade the long term quality of life here for short term real estate profits.

Facts

Comparing Muirfield Village to Matanzas is crazy! That property is controlled by Jack Nicklaus…why not ask Palmer to buy Matanzas and turn it in to Bay Hill? It’s like comparing apples to shards of glass! No residents have a clue of the issues with the old golf course and no one seems to contact the people that do! There is a reason that the former owners did not renovate it, the current owners haven’t renovated it and no group has come in willing to under take the tremendous task! More goes in to golf course construction than planting grass! How is the irrigation system? Can it be used or need to be replaced. It has been sitting a number of years, so its safe to say…replaced!Is there drainage under the greens? Is the old greens mix still good?How many trees need to come down? In what shape are the bridges and cart paths? What is the status of the CUP with the local water district? How much good/usable grass is left? Does everything need to be replanted? The $5million number proves to be accurate. That number would be exceeded if built properly! Me. McKenna has talked to an old associate with Palmer. Here is the cold truth about Palmers design firm…during the time that Matanzas was built he mass produced designs. Both he and his associates had nothing to do with the construction, they designed it and put his name on it! People need to get their facts straight before demanding anything! I am yet to read anything that makes not only economic sense, but agronomic sense! The agronomy is just as important! Just do yourself a favor and ask someone who knows!

The Answer Is Simple

It really doesn’t matter what facts are presented or what perspectives are offered at this point. There is a group that insists that golf is “under served” in the area and therefore a fully re-opened Matanzas Woods would be profitable. They also insist that the estimates to re-open are “inflated” and therefore re-opening would then be rather inexpensive. They insist they are the authority.

So, the answer is simple . . . they should take the risk and re-open the course. Form an LLC, put the business plan together, secure the funding (not on the backs of the homeowners either), purchase the property and business from the Golf Group, and re-open the course. Prove everyone they are wrong. It really is that simple.

Clarification

A bit of clarification. I am in no way comparing Muirfield Village to Matanzas; apples and oranges to say the least. I was simply stating that other areas of the country, Central Ohio in this case, have many more courses than this area and golf is highly thought of and still a very popular pass time. While I have played Muirfield as a guest, we normally played Granville Golf Course which is a public Donald Ross course and Apple Valley Golf Course in Ohio. Apple Valley is more of a Matanzas type course with modest houses and modest rates. If you ever get the chance to play the Granville Course, go for it. It is a wonderful, affordable golf experience.

Clarifying the Clarification

Mr. Douglass,

The Central Ohio area, namely Franklin County where Muirfield Village is located, has a population of over 1 million people as you should know. Flagler County has about 95,000. Slightly different market sizes don’t you think? In fact, I think we could look at many industries in that area and compare them to find they are more robust in Central Ohio. It’s not because Central Ohio likes things more, there’s just a lot more people living there.

Nothing about the Matanzas Golf Course situation has ever been about golf not being “highly thought of” in Palm Coast and Flagler County. Why do you think the City of Palm Coast acquired and reopened Palm Harbor at a really bad economic time for the area? That was the course everything was built around in the town. Many were strongly opposed to the City doing that as well. I actually was in favor of what the City did then. And that course has also taken valuable tax dollars away from other important services, and continues to operate at a loss. That’s how committed many people are to the industry here. But the tax payers can’t continue to bear the burden of failed businesses. It’s not because they don’t appreciate or think highly of the industry, it’s because it’s not the responsible thing to commit resources when all indicators show they will be wasted. Do you invest in things you know will lose your money based upon the information you have? Do you normally recommend others invest their money in a venture you know will lose their money?

It’s about facts whether you and your group chose to accept reality or not. Your group has just cost every homeowner in Matanzas Woods the ability to finally begin regaining the value they lost in their properties and equity gains for those that purchased more recently, because you all feel strongly that the course can be a profitable business. And you all insist everyone else is wrong. So do what people normally do (and the responsible thing because of the position you all have put your neighbors in) when they see a business opportunity . . . take the risk and re-open the course. If you all are so adamant that everyone else is wrong, and you all are right then why are you all so hesitant on just committing to take the risk and re-open the course yourselves and truly “save the course”?