A Hidden Tax on Housing – The Impact of Impact Fees

Impact Fees, Water & Sewer Connection Fees, and other fees add about $20,000 to the cost of every single-family home in Palm Coast, not just new construction.

PALM COAST, FL – July 30, 2017 – Today's Daytona Beach News-Journal front-page story and Opinion column about Latitude Margaritaville’s exemption from school impact fees requires clarification and further discussion.

Latitude Margaritaville is a new age-restricted (55-and older) development in neighboring Volusia County. Florida statute exempts new construction in 55+ communities from paying school impact fees. Volusia County’s school impact fee is $3,000 per new single-family home. The exemption was passed in 2000 after a Florida Supreme Court ruled that because 55+ communities do not allow young residents, they do not contribute to the need for additional schools.

The N-J article correctly points out that the first phase of the Minto Communities-developed Latitude Margaritaville, consisting of 3,400 single-family residences, will avoid paying $10.2M in school impact fees. That savings will more than double as the community reaches its planned capacity of 6,900 homes.

The N-J editorial staff thinks this is a travesty. Their Opinion Page piece urges Florida to “amend its constitution to eliminate this inequity.”

Background

Impact fees grew out of the reduction in Federal and State grants to local governments and the growth of the tax revolution in the late 1970s. Originated as capital recovery fees to fund water and wastewater facilities, they quickly grew to include several non-utility facilities such as roads, schools, parks, fire, and police. Currently, over half of all states have passed impact fee enabling acts, primarily in the rapidly urbanizing Sunbelt and Rocky Mountain West.

Impact fees are based on the concept that “growth should pay its own way.” Naturally, current residents would rather see the newcomers pay for the cost of increased infrastructure and services. It’s better than increasing everyone’s property tax. The fees vary from jurisdiction to jurisdiction. While Volusia’s school impact fee is $3,000, Flagler’s is $3,600.

Impact fees collected from each new single-family home in Palm Coast are:

- Park System Impact Fee – $849.24

- Fire & Rescue System Impact Fee – $218.79

- Educational Facilities Impact Fee – $3,600

- Transportation Impact Fee – $3,124.67

- Water System Contribution in Aid of Construction – $2,888.64

- Sewer System Contribution in Aid of Construction – $4,065.88

Total Impact Fees – $14,747.22

(‘Contribution in Aid of Construction’ is a euphemism for Impact Fee)

Typically, additional fees and charges for installation, inspections, plan reviews, administrative costs, etc. by Palm Coast add $5,000 to $6,000 more to each new Palm Coast home. Impact and other fees are paid by the builder and passed onto the buyer in the cost of each new home.

N-J Arguments addressed one-at-a-time.

The N-J argues that another 55+ development planned for 1,755-homes near Latitude Margaritaville “agreed to make an upfront payment of $500,000 in school impact fees that will allow nearby Westside Elementary School to be renovated and expanded.”

GoToby responds: Such agreed upon payments are often the result of bureaucratic arm twisting and are seldom voluntary. Even if it was truly voluntary, the developer’s payment equals only $284.90 per home, a far cry from $3,000 per home.

The N-J argues that the exemption “represents a flaw in the system.” For example, “retirees may not have a direct use for schools, but the developments in which they live can attract construction workers and support staff with children to relocate here and create a need for increased school capacity.”

GoToby responds: This is a specious argument unless the families of construction workers and support staff are all homeless. They live someplace, presumably a home, apartment, or condo that was not exempt from impact fees.

The N-J argues, “Schools are used as emergency shelters open to all residents, even those evacuating homes in age-restricted neighborhoods.”

GoToby responds: The school was built with education as its primary purpose. The ancillary use of the structure as an emergency shelter does not increase the construction costs The same response applies to any claim that seniors can avail themselves of adult education opportunities at the school. These classes utilize existing classrooms during off-hours.

The N-J argues, “If a community decides impact fees are an appropriate way to maintain schools, then the fees should apply to all.”

GoToby responds: Impact fees are not meant to “maintain schools.” They are specifically assessed to help pay for the construction of new schools or additions to existing schools caused by increased population. The homeowners of Latitude Margaritaville will still pay annual property taxes which include a hefty amount for school operations and maintenance; their contribution towards the community benefit of good schools and a well-educated populace. (They will also pay non-school impact fees.)

An important point, often overlooked, is the recognition that impact fees are simply another tax. It is a lawful taking by a governmental entity. It is not voluntary (If it walks like a duck….). Therefore, it is a tax, a tax that keeps on giving.

The downstream impact of impact fees

Impact fees for each new home permitted in Palm Coast total $14,747.22, raising the cost of each new home buyer accordingly. Using a traditional mortgage, a new homebuyer will need an additional $2,949.44 cash to cover a 20% down payment. The amount of mortgage financing will increase by $11,797.78, increasing the monthly mortgage payment accordingly. Documentary stamps will be more costly and real estate commissions will be roughly $885.00 higher.

The new home’s impact fee burden will be baked into the initial Property Appraiser’s assessment of “just value”, assuring that each year, the homeowner’s property tax is proportionally higher, including the portion of the property tax going towards schools. Since it affects the initial valuation, it raises permanently the baseline for homesteaders’ “save our homes” exemption.

Ah, you say, “But it only affects new homes.” Not so. In a relatively stable housing market, existing homes sell at a slight discount to new construction. The premium a buyer is willing to pay for new construction is determined by market forces. To the extent that impact fees inflate the value of new construction, they inflate the value of comparable existing inventory as well; meaning we all pay more. Impact fees inflate down payments, financing, buying and selling costs, and taxes on ALL real estate.

Commercial impact fees

Commercial construction falls under different impact fee schedules. Rightfully so, they are exempt from school impact fees. But you might be surprised to find out that a new fast food restaurant with a drive thru pays $40,547.73 in transportation impact fees for each 1,000 square feet of building space. The transportation impact fee for the new Starbucks at Belle Terre and SR100 was $89,205.01.

A new grocery store is assessed $9,614.91 per thousand square feet for a transportation impact fee. Aldi’s transportation impact fee was $171,385.77. Racetrac’s transportation impact fee for its new gas station and convenience store on SR 100 was $110,072.17.

Commentary

Impact fees are problematic. They are arbitrary and capricious. Fees are typically developed from studies done by outside consultants, giving them the appearance, but seldom the substance, of legitimacy. It seems somehow odd that Flagler’s school impact fee is 20% higher than Volusia’s. Is it possible that school construction costs in Flagler County are 20% higher than those in neighboring Volusia County?

Palm Coast’s Park System Impact Fee is precise; $849.24, not $849.23 or $849.25 or more simply $850. The fee was determined by taking a hypothetical new park from raw land to completion, including land acquisition, design, engineering, site development, and construction. In the real world of residential development, Palm Coast’s parks often come heavily subsidized by the developer.

Most new development orders include a “voluntary” contribution of land for a park. The developer may also be urged to provide design, engineering and site development for the park. Approval of a large scale development is typically contingent upon a voluntary donation of land for school(s) as well. And you may recall that Palm Coast’s new city hall was built on land “donated” to them by the developer of Town Center.

Follow this link for a complete schedule of fees: City of Palm Coast Summary of Application and Impact Fees

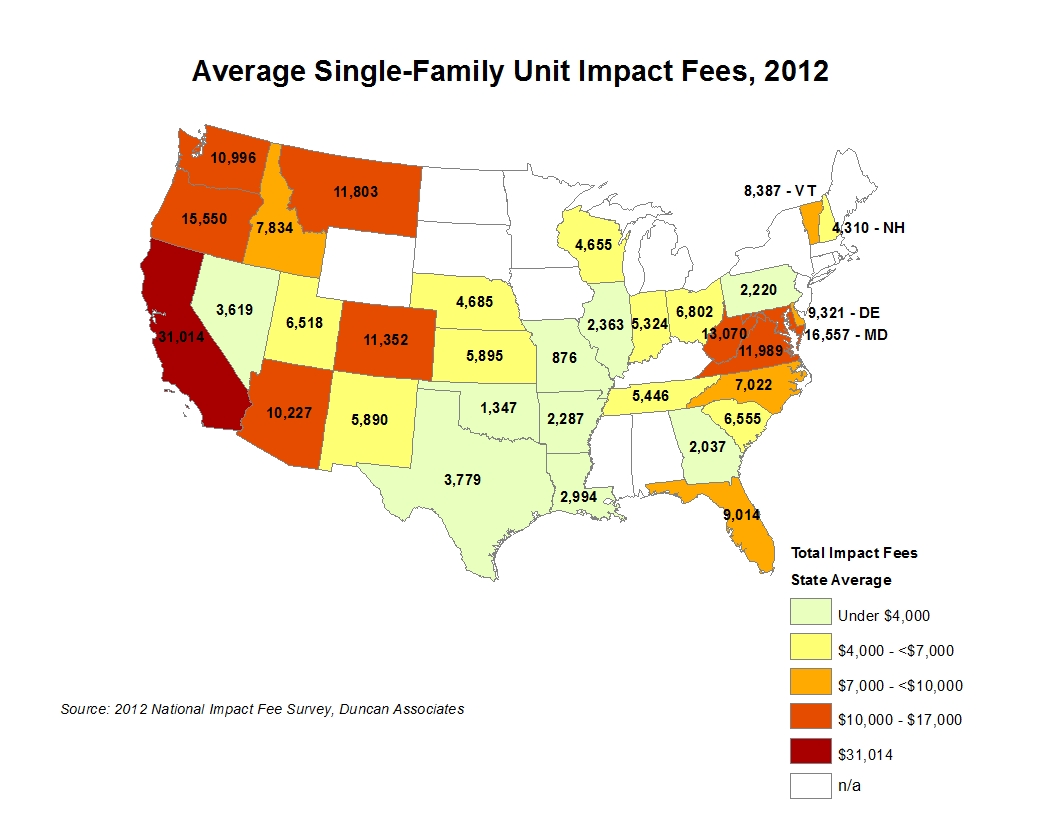

The following graphic illustrates the disparity of impact fees from state to state. But we can always throw in a couple digits to the right of the decimal point to anoint them with precision and accuracy.

Fees Fairness

Nice write up/ summary Toby. If the Gov’t spent the money as accurately as they peg the fees ( as you outline), it may be easier to accept. The other side of the coin is the pool of home owners who have paid already and how to rationalize their overall equity in the equation.